Occupational Pensions in Ireland

An occupational pension, also referred to as a workplace, company or employers’ pension plan, is a retirement scheme provided by your employer. These schemes are designed to offer a steady income stream post-retirement. Additionally, some occupational pension schemes may offer a lump sum payment upon retirement.

What’s in this guide?

What is a workplace pension?

How do workplace pensions work?

Who is eligible for a workplace pension?

Different types of workplace pensions

How much do I need to contribute to my pension pot?

Where your workplace pension is invested

Cashing in your workplace pension

Useful Links / Documents

Common Questions about Occupational Pensions in Ireland (FAQ)

What is a workplace pension?

An occupational pension, also known as a workplace, company or employers’ pension plan, is provided by your employer to help you save for retirement. These schemes typically offer a regular income stream after retirement, and in some cases, they may also provide a lump sum payment upon retirement.

At present, there’s no legal requirement for employers to offer occupational pension schemes to their employees; however, auto-enrolment is due to start this year (2024). While many large employers in Ireland do provide such schemes, smaller employers may not.

If your employer doesn’t offer an occupational pension scheme, they are required to provide access to another type of pension plan called a Personal Retirement Savings Account (PRSA).

Each pension scheme operates under its own set of rules, and they are generally regulated by the Pensions Authority. Members of pension schemes have certain rights, such as the right to receive information about their pension.

Contributions to pension schemes are eligible for tax relief.

How do workplace pensions work?

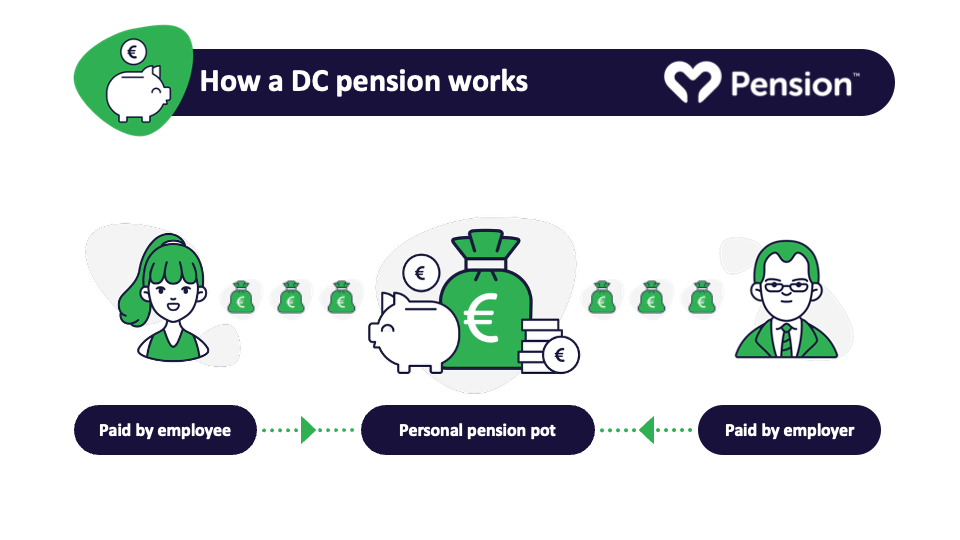

A defined contribution company pension, also known as an occupational pension, is set up by an employer. Employees typically contribute a fixed portion of their salary (5% for example), with the flexibility to make additional payments if they want to. The objective is to accumulate a fund that will provide sufficient income for retirement.

In such pension schemes, employers often make contributions on behalf of their employees, (some companies might match up to a certain percent, such as 5%). This employer contribution is a significant advantage, making company pensions an attractive option for many individuals.

Example

Stephen is a Project Manager and earns €52,000 per year. His company have a workplace pension scheme and will match his pension contributions up to 5%. Stephen makes a monthly contribution of 5% of his salary (€217), and his employer matches that contribution of 5% (€217), so each month, Stephen has €434 going into his pension. However, Stephen also gets marginal rate tax relief of 40% on his personal contribution, saving him €87, meaning the €217 contributed by Stephen actually only costs his €130. In effect, Stephen is getting €434 in his pension, for a cost to him of €130.

Who is eligible for a workplace pension?

There’s no legal requirement for employers to offer occupational pension schemes to their employees. While many large employers in Ireland do provide such schemes, many smaller employers do not.

In cases where an employer does not offer an occupational pension scheme, they are required to provide access to an alternative type of pension plan known as a Personal Retirement Savings Account (PRSA).

Different types of workplace pensions

There are 2 main types of occupational pensions in the private sector.

- A company pension scheme offered by your employer.

- A Personal Retirement Savings Account (PRSA), provided by your employer by law if they don’t have a company pension scheme in place.

A company pension scheme offered by your employer.

A defined contribution company pension, also known as an occupational pension, is established by an employer. Typically, employees contribute a fixed percentage of their salary, with the flexibility to adjust this contribution over time. The primary goal is to accumulate a fund that will provide sufficient income during retirement.

One attractive feature of company pensions is that employers often make contributions on behalf of their employees. This employer contribution is a significant advantage that makes company pensions appealing to many individuals.

Example

Mary works at a Marketing Firm and earns €60,000 per year. Her company have a workplace pension scheme and will match her pension contributions up to 5%. Mary makes a monthly contribution of 5% of her salary (€250), and her employer matches that contribution of 5% (€250), so each month, Mary has €500 going into her pension. However, Mary also gets marginal rate tax relief of 40% on her personal contribution, saving her €100, meaning the €250 contributed by Mary actually only costs her €150. In effect, Mary gets €500 in her pension at a cost to her of €150.

A Personal Retirement Savings Account (PRSA)

A Personal Retirement Savings Account (PRSA) is an individually owned pension plan that provides flexibility in saving for retirement. With a PRSA, you can contribute to your retirement savings whenever you want (weekly, monthly, annually, etc.), and can stop making contributions at any time.

Contributions made to a Personal Retirement Savings Account (PRSA) are eligible for income tax relief, up to specified limits. Additionally, any growth in your retirement fund within the PRSA is tax-free. Upon retirement, you may have the option to withdraw a lump sum, with a portion of it potentially being tax-free, subject to certain limits and conditions.

Contributions

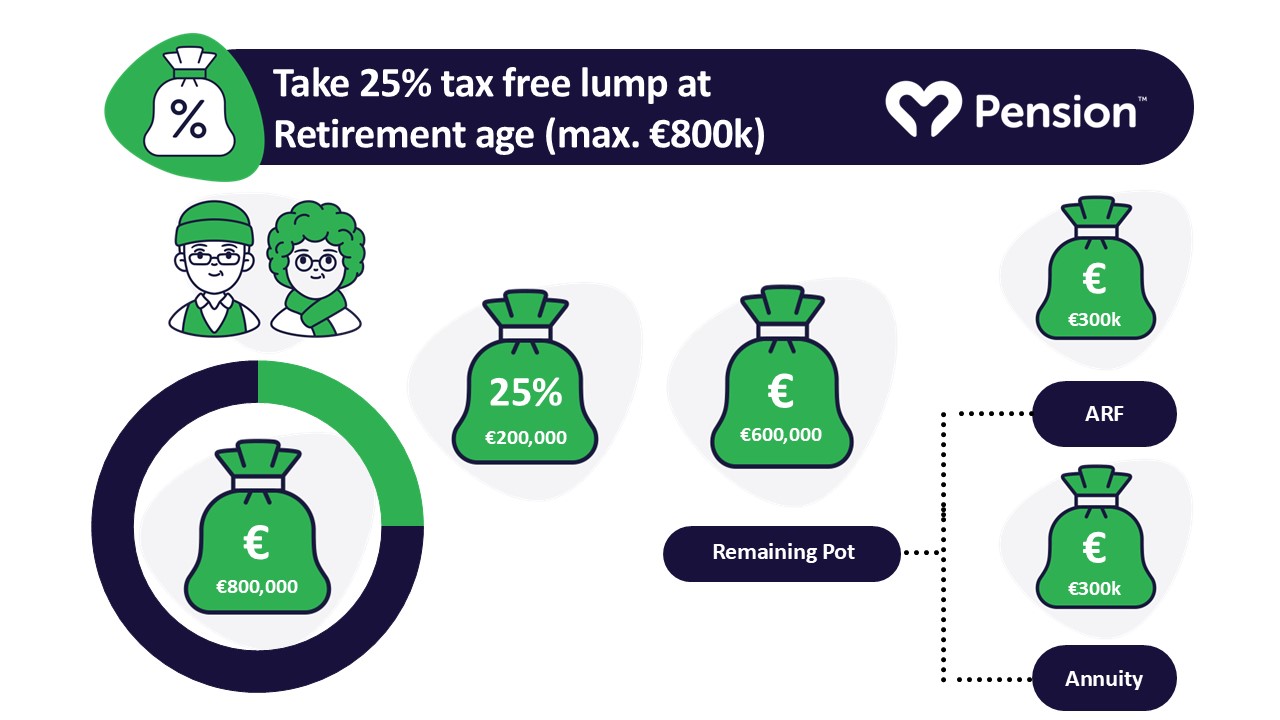

Your tax-free contribution limits depend on your age and how much you earn, as illustrated below.

The percentages represent maximum amount of your earnings you can contribute with income tax relief, up to a maximum salary of €115,000 per annum, meaning that if you earn over this amount per year, you can still only receive tax relief on the percentage by age range on €115,000 of that per year.

If you’re a professional athlete, your limit will be 30% of earnings, regardless of your age.

How much do I need to contribute to my pension pot?

When it comes to working out how much you need to contribute to your pension to get the desired income throughout retirement, you first have to determine what income you want in retirement.

There’s various guides to help determine sufficient amounts, and different lifestyles call for different measures; however, as a general rule of thumb, we advise at least 33% of your salary (not including the State Pension).

Let’s say you’re earning €50,000 per year and you retire at 65. 33% of your current salary would be €16,500 per annum, plus state pension €14,400 per annum = €30,900 pa.

Use our pension calculator to determine what you should be contributing now based on your current circumstances, to reach your desired income at retirement.

Pension Calculator

Find out your likely retirement income.

Where your workplace pension is invested

Workplace pensions are generally invested via life companies. In Ireland, the main life companies offering pensions are:

- Aviva

- Irish Life

- New Ireland

- Royal London

- Standard Life

- Zurich

The funds offered are typically diverse and consist of lots of different investment options, such as stocks and shares, assets, commercial estate, bonds, etc.

Funds are split into risk categories, ranging from very cautious to very adventurous. Some workplace pensions will be formed of several different and diverse funds, selecting a range of risk categories and funds, to help balance performance.

The seven risk categories are explained below

We’ve boiled down people’s feelings about risk into seven categories. They’re behind all the investment options we give you.

Very Cautious

Knowing your money is safe matters more than high returns. You’d rather keep it in the bank than invest it in the stock market.

Cautious

You don’t like taking risks with your investments. You’d rather keep your money in the bank, but you’ll think about other investments if they work out better in the long run.

Moderately Cautious

You’re usually uncomfortable taking risks with your investments. You might be willing to take limited risks because you know that could bring better returns in the long run.

Balanced

You know that reaching your investment goals means taking risk. So you’re ready to do that with at least some of your investments.

Moderately Adventurous

You’re ready to take a risk with a substantial chunk of your investments because you know it could result in better returns in the long run.

Adventurous

You’re happy to take on risk with most of your investments. You know it’s crucial for returns in the long run.

Very Adventurous

You’re ready to take considerable risks with all your investments to get the highest returns you can.

Cashing in your workplace pension

Company pensions are generally structured to be drawn down during retirement years. However, in certain circumstances, you may be able to access your pension from the age of 50 if you are no longer employed by your employer, and if both the trustees and employer consent to this arrangement. Additionally, early retirement may be possible at any age if you are in ill health and incapable of returning to work.

It’s crucial to note that accessing your pension early may result in lower funds compared to waiting until the Normal Retirement Age (NRA).

Useful Links / Documents

Pension Calculator

Find out your likely retirement income.

Find your old Workplace Pensions

Sign-up and find all of your pensions.

Common Questions about Occupational Pensions in Ireland (FAQ)

When can I withdraw my pension?

You can only access your company pension upon retirement. Company pensions are primarily structured to be drawn down during retirement years. In Ireland, the average retirement age is 65. However, under specific circumstances, you may access your pension from the age of 50 if you are no longer employed by your employer and both the trustees and employer consent to this arrangement. Additionally, early retirement may be possible at any age if you are in ill health and unable to return to work.

It’s essential to bear in mind that accessing your pension early may result in lower funds compared to waiting until the Normal Retirement Age (NRA).

Will I still get the State Pension (Contributory) if I have an occupational pension scheme?

Yes, State Pension (Contributory) is not subject to means testing and is accessible even if you have alternative income streams, such as an occupational pension. You can begin receiving the State Pension (Contributory) at the age of 66 provided you have accumulated a sufficient number of social insurance (PRSI) contributions. It’s sometimes referred to as the old-age pension.

To find out more about the State Pension in Ireland, click here.

Can I leave my pension pot to my spouse or family?

Yes. When you die, your pension goes to your “estate”, so having a Will in place is highly advisable for family members to have access to your pension efficiently.

What is a defined benefit occupational pension?

In a defined benefit scheme, your entitled benefit is predetermined. This could be linked to factors such as your length of service.

Occupational pension schemes may combine features of both defined benefit and defined contribution schemes, known as hybrid schemes. In these hybrids, you can anticipate a specific income, akin to a defined benefit scheme, while the remaining portion may fluctuate, subject to defined contribution principles.

Do you pay PRSI on occupational pension?

You do not pay the Universal Social Charge on your occupational pension, but it may apply to other sources of income (such as employment or self-employed income). Individuals aged over 66 are exempt from paying PRSI.

Are occupational pensions tax free?

Contributions

Your tax-free contribution limits depend on your age and how much you earn, as illustrated below.

The percentages represent maximum amount of your earnings you can contribute with income tax relief, up to a maximum salary of €115,000 per annum, meaning that if you earn over this amount per year, you can still only receive tax relief on the percentage by age range on €115,000 of that per year.

If you’re a professional athlete, your limit will be 30% of earnings, regardless of your age

Age |

Percentage of earnings you can contribute |

Under age 30 |

15% |

30 to 39 |

20% |

40 to 49 |

25% |

50 to 54 |

30% |

55 to 59 |

35% |

60 and above |

40% |

Tax related to withdrawing your occupational pension:

When it comes to withdrawing your occupational pension, it is considered a taxable source of income, subject to Income Tax, Universal Social Charge (USC), and potentially Pay Related Social Insurance (PRSI), similar to employment income.

What happens to my pension when I leave a company before retiring?

When you leave a company in Ireland prior to retirment, you generally have three primary options on what to do with your pension:

- Leave your benefits in your existing pension arrangement.

- Transfer your benefits to your new pension arrangement.

- Take a refund of contributions, which is only available in limited circumstances.

To find out more about your options, speak with one of our advisors today.

Is it better to take a lump sum or monthly pension?

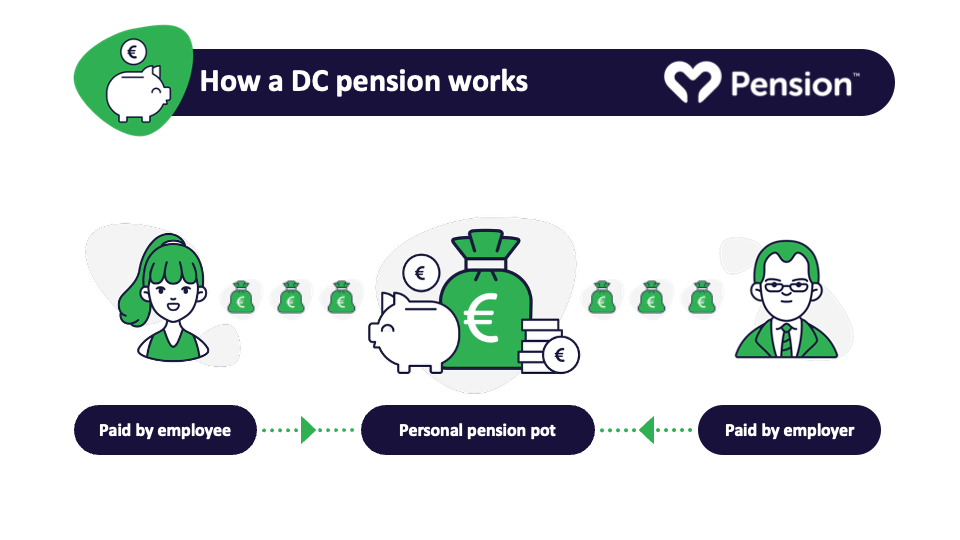

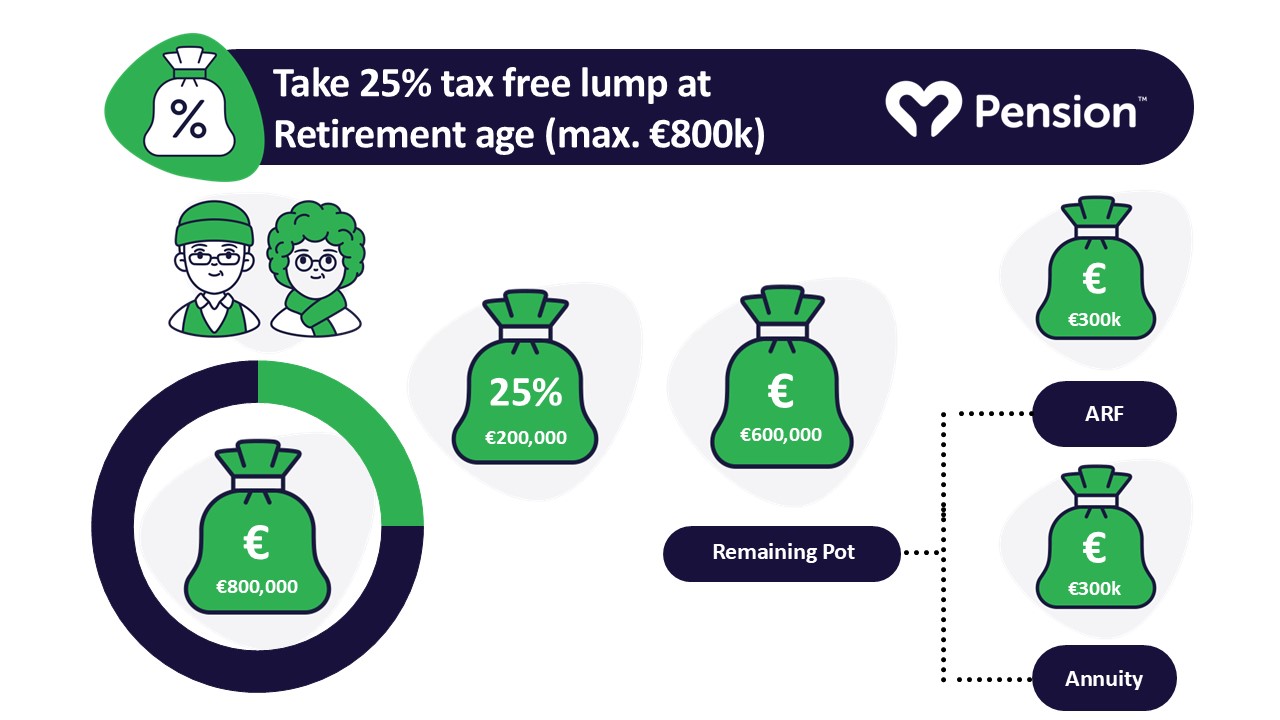

When you retire, you’ll have several options for managing your pension fund. One common choice is to take a portion of it as a tax-free retirement lump sum, which many individuals opt for.

The amount of tax-free lump sum you can take is determined by various factors, including the rules of your pension plan, any previous tax-free lump sums you’ve received from other pension plans, and limits established by Revenue.

As of 2024, the maximum amount of tax-free lump sum you can take is:

- Up to 25% of your retirement value, capped at €200,000, for a personal pension. For example, if you have €800,000 in your pension, you could take the full €200,000 tax-free lump sum.

- Up to 1.5 times your final salary, depending on your years of service, for an occupational pension.

Take control of your retirement, with MyPension

View all your pensions in one place. MyPension allows you to easily manage your pensions, with features such as combining, contributing and making withdrawals. Your pension, in the palm of your hands.

Cathedral Financial Consultants Ltd t/a My Pension is regulated by the Central Bank of Ireland. With pension investments, your funds might fluctuate in line with investment market movements.

Client services

© Copyright 2026 Cathedral Financial Consultants Ltd t/a My Pension. Registered in Ireland No: 369995.