Transferring My Pension

Learn more about pension transfers Ireland. Find out your options, when to consider it and what considerations to take when making a decision to switch (special benefits, exit clauses, etc.).

What’s in this guide?

What is a pension transfer?

What kind of pensions can be transferred?

Why Consider Pension Transfer?

Risks Involved in Pension Transfers

Steps to Follow When Transferring Pensions

What are the costs associated with pension transfers?

Should I transfer my workplace pension when I leave a job?

Useful Links / Documents

Common Questions about Transferring your Pension in Ireland (FAQ)

What is a pension transfer?

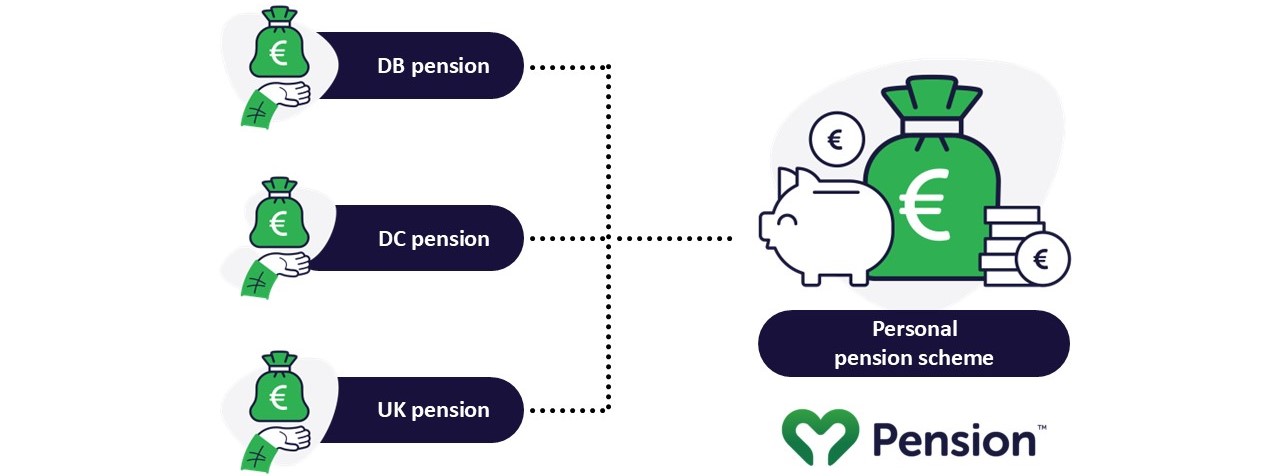

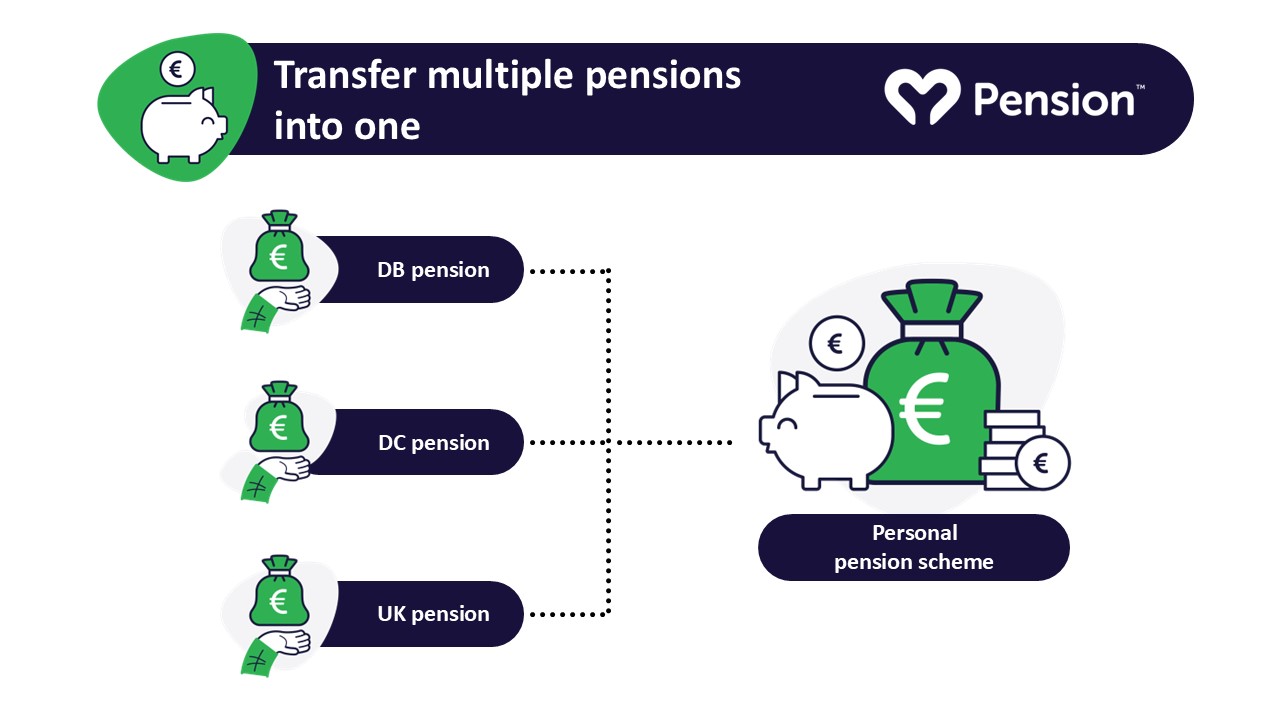

A pension transfer involves moving your pension fund from your current financial provider to a new one. You may choose to switch from a defined benefit plan to a defined contribution plan, or to a personal pension or a pension retirement savings account (PRSA).

This decision might be prompted by a career change to a new company, the closure of an existing pension scheme, or an effort to consolidate multiple pensions accumulated throughout your career.

If you are wondering is transferring a pension is right for you, speak with one of our advisors today. Our team of Qualified Financial Advisors are there to ensure you get the right advise, as some pensions might come with special benefits or low fees that you might want to keep.

What kind of pensions can be transferred?

The amount of risk involved in transferring your pension depends on various factors specific to your personal circumstances. The first step is understanding what type of pension you have and the alternatives available for transfer.

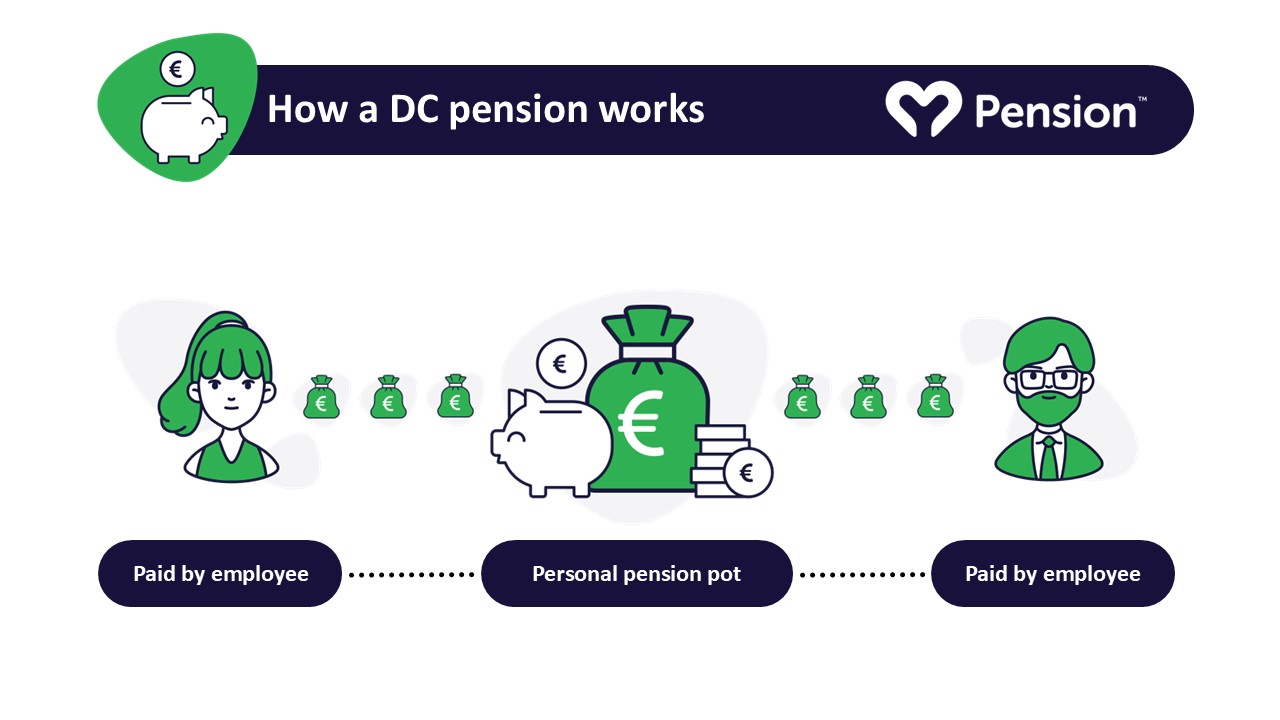

Defined Contribution Pension: This is the most common type of pension, where both you and your employer contribute. Defined contribution pensions can usually be moved at any time to another contributory pension or to a Personal Retirement Savings Account (PRSA) or Personal Pension Plan (PPP).

Defined Benefit Pension: This type of pension guarantees a fixed amount upon retirement. Transferring a defined benefit pension is more complex because long-term benefits might be lost in the transfer. It is crucial to seek independent financial advice before making this move. Some companies offer high transfer values, known as Enhanced Transfer Values, to employees with defined benefit pensions. Understanding the pros and cons of transferring a defined benefit pension is essential before making a decision. You can learn more about the pros and cons of transferring a DB pension by speaking with one of our Qualified Financial Advisors, today.

Personal Retirement Savings Account (PRSA): You may choose to transfer your defined contribution or defined benefit pension to a PRSA. This option is popular among individuals transitioning from employment to self-employment, allowing them to manage their pension planning independently. A PRSA is a flexible pension plan that can be started or stopped as needed and can accept both lump sum payments and monthly contributions, making it suitable for the fluctuating income of self-employment.

Personal Pension Plan (PPP): Newly self-employed individuals might consider transferring their company pension to start a personal pension or PPP. This pension type can receive personal contributions and contributions from your own company, with tax relief available at the marginal rate of 20% or 40%, depending on the amount. Minimum payments to the fund may be required, and various fund types are available to match your risk tolerance. After an assessment, you will be offered funds that align with your desired risk level.

In summary, understanding the type of pension you have and exploring your transfer options with the help of a financial advisor is crucial to making an informed decision about moving your pension.

Why Consider a Pension Transfer?

There are several reasons why you might choose to move your pensions between providers:

- Consolidation: If you have worked for multiple companies, you may have accumulated several pensions. Combining them into one new pension plan can simplify your financial management.

- Better Benefits: Transferring your pension might allow you to take advantage of better benefits offered by another provider.

- High Fees: You might seek a new provider to reduce the fees associated with your current pension, aiming to save on costs.

- Returning Home: If you have worked abroad, you might want to return to your home country and bring your pension with you.

- Plan Closure: Your current pension plan may be closing, either by your employer or the pension provider, prompting the need for a transfer.

- Moving Abroad: Planning to move abroad might require transferring your pension to align with the new country’s pension system.

Risks Involved in Pension Transfers

- Exit Charges and Penalties: Many pensions have built-in exit charges and penalties to discourage transfers. Before initiating a transfer, thoroughly check what these penalties are for your specific plan, as they may be higher than expected.

- Guaranteed Annuities or Rates: Investigate whether your current pension includes guaranteed annuities or rates that may be lower with the new provider. These benefits can be difficult to identify in your pension documentation, so it is crucial to seek advice from an independent advisor.

- Cooling-off Period: Most new providers offer a period during which you can change your mind about the transfer. Ensure you are informed about this period upfront. However, confirm whether you can return to your old provider with the same benefits if you decide to reverse the transfer, as not all providers will reinstate your previous arrangements.

- Provider Bonuses: Some providers offer bonuses at pay-out to discourage transfers. Check if your current provider offers such bonuses and evaluate whether the benefits of transferring outweigh the potential bonuses you would lose.

- Tax Implications: Understand the tax implications of your transfer and how they might affect your pension pot at pay-out. Different pension plans have varying tax arrangements, making it essential to get advice on this aspect of your decision.

- Risk Transfer: If moving from a defined contribution pension to a personal plan, be aware that the risk shifts entirely from your employer to you.

- Proximity to Retirement: Consider your age and how close you are to retirement. The closer you are to retirement, the smaller the benefits of moving may be, as you are exposing yourself to potential risks. It may not be advisable to transfer if you are near retirement.

Carefully evaluating these factors with the help of a financial advisor can help you make an informed decision about transferring your pension. To find out if you should transfer your plans, speak with one of our Financial Advisors, today.

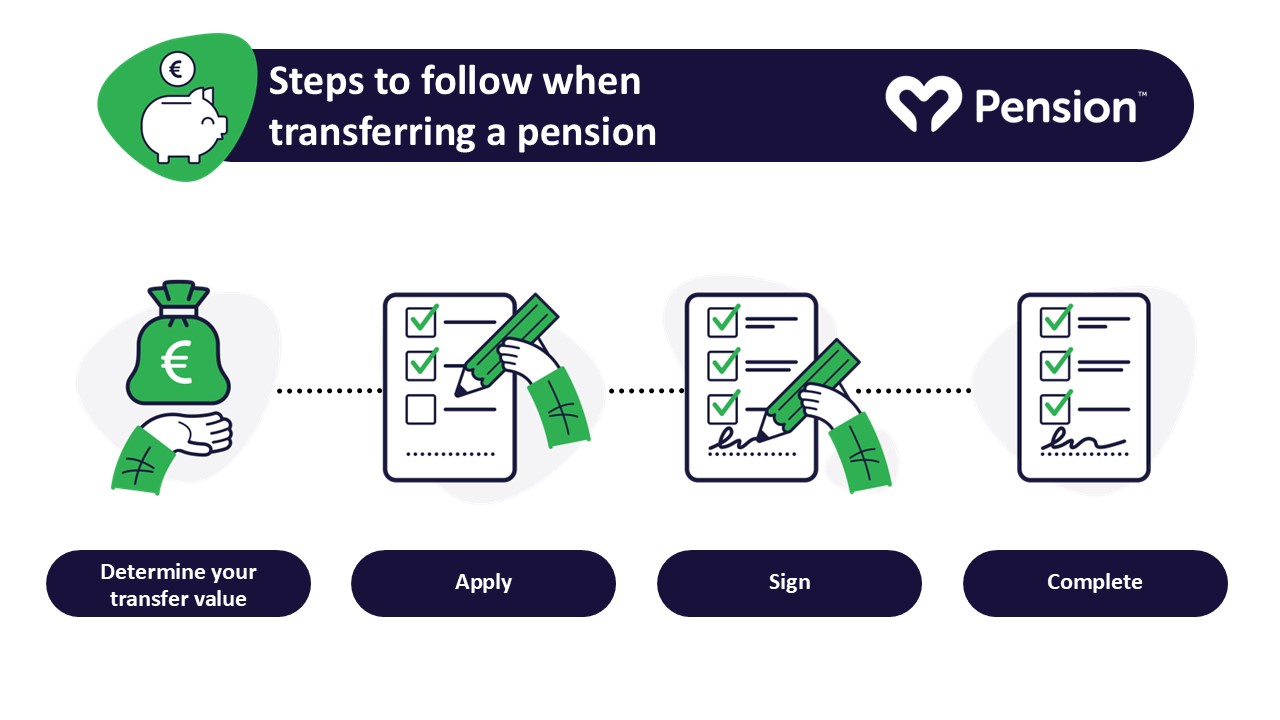

Steps to Follow When Transferring Pensions

The Process of Moving Your Pension

Transferring your pension involves significant administrative work, which MyPension can assist with. However, it’s crucial to stay fully informed at every step of the process.

- Determine Your Transfer Value: The first step is to know your transfer value, which is the total amount accumulated in your pension pot over your working life. Your current provider can supply this information. You will receive a document outlining:

- Your transfer value

- Details of any benefits accrued

- Potential costs of transferring (such as exit fees and charges)

- Technical information needed for the transfer

- Application Process: Your new provider will have an application process to initiate the transfer, typically involving forms that need to be completed. While this can often be done online, some cases may require physical forms to be returned to the new provider.

- Permissions and Forms: These forms will grant your new provider permission to contact your current provider to start the transfer process. Your current provider may also require you to complete additional forms and will inform you of any charges or penalties for transferring out of their scheme.

- Transfer Timeline: Once all paperwork is submitted, the transfer process typically takes around six weeks but can sometimes take longer. The duration depends on the efficiency of both providers and the timely exchange of information.

- Investment Continuity: During the transfer period, you remain invested, so you do not lose any pension periods. The continuity ensures that your pension continues to grow or accumulate during the transfer.

By understanding these steps and collaborating with both your current and new providers, you can ensure a smooth and informed transfer process.

Our team of Qualified Financial Advisors and Pension Administrators are there to facilitate and advise you, every step of the way. To determine whether you should transfer your pension(s), speak with one of our Financial Advisors, today.

What are the costs associated with pension transfers?

Transferring your pension involves costs, but these may be outweighed by the benefits offered by your new provider. To ensure that you benefit from the transfer, you need to determine your current provider’s exit costs. These costs can include a penalty for transferring, often called an exit fee, which is usually a percentage of your total value.

Your Financial Advisor will help you understand costs associated with transferring your pension and what the potential new plan fees are, so you can make an informed decision, backed by Financial Advice. This isn’t a process you will have to navigate alone, MyPension is here to help you every step of the way, providing the right advice for you.

To determine whether pension transfer is right for you, speak with one of our Financial Advisors, today.

Should I transfer my workplace pension when I leave a job?

Thinking about leaving your current employment and wondering what your options are?

The options available to you depend on the type of pension plan you have, whether it is:

- Defined Contribution (DC)

- Defined Benefits (DB)

Most private company pensions are defined contribution (DC), while civil and public servants are typically in defined benefits (DB) pension schemes.

Defined Contribution (DC) Plans:

- Leave it as is: You can leave your pension with your former employer’s scheme, where it will continue to be invested.

- Transfer to a new employer’s scheme: If your new employer offers a pension plan, you may be able to transfer your funds into their scheme.

- Transfer to a personal pension: You can move your funds into a personal pension plan, which gives you control over your investments.

- Cash out: Depending on the terms of your plan and your age, you might be able to withdraw your pension as a lump sum, although this could incur taxes and penalties.

Defined Benefits (DB) Plans:

- Deferred benefits: Your pension benefits are preserved and will be paid out upon reaching retirement age, based on the formula set by the plan.

- Transfer value: You might have the option to transfer the value of your pension to a new employer’s scheme or a personal pension plan.

Next Steps:

- Assess your options: Evaluate the pros and cons of each option based on your personal circumstances and future plans.

- Seek professional advice: Consulting a financial advisor can help you make an informed decision tailored to your specific situation.

- Review terms and conditions: Ensure you understand any fees, penalties, and the long-term impact on your retirement benefits before making a decision.

The options available will depend on which type of pension you are in, so it’s crucial to understand the specifics of your pension plan before proceeding.

To determine if transferring your pension when leaving a job is right for you, speak to one of our Financial Advisors, today.

Useful Links / Documents

Pension Calculator

Find out your likely retirement income.

Find your old Workplace Pensions

Sign-up and find all of your pensions.

Common Questions about Transferring your Pension in Ireland (FAQ)

Is it a good idea to bring all my pension pots together?

Combining pension pots is often perceived as easier to control; however, MyPension allows you to manage all pensions in one place, so the need to combine all pension into one is no longer necessary to have more perceived control. We wouldn’t typically advise on combining all pensions into one, as it’s often better to diversify your portfolio. We assess you independent pots and circumstances and would look to structure the pensions into a portfolio that can be easily managed using our MyPension platform, providing less risk than having all you pensions in one pot, whilst maintaining the immense benefits of managing all pensions in one place.

Will I lose any valuable pension benefits?

Without understand the benefits and how they translate (exit fees, benefits within the current plans, fee structure of new plans), you run the risk of losing great benefits if you try facilitate this transfer without a Financial Advisor.

Our team of Qualified Financial Advisors are there to ensure you don’t transfer a pension with better benefits to another. They will review your current pension benefits against the perceived value of other pension funds available, and make an informed recommendation backed by considerations such as fees (exit and management), past performance, your attitude to risk and retirement goals.

What investment choices are available if I move my pension?

Defined Contribution (DC) Plans:

- Leave it as is: You can leave your pension with your former employer’s scheme, where it will continue to be invested.

- Transfer to a new employer’s scheme: If your new employer offers a pension plan, you may be able to transfer your funds into their scheme.

- Transfer to a personal pension: You can move your funds into a personal pension plan, which gives you control over your investments.

- Cash out: Depending on the terms of your plan and your age, you might be able to withdraw your pension as a lump sum, although this could incur taxes and penalties.

Defined Benefits (DB) Plans:

- Deferred benefits: Your pension benefits are preserved and will be paid out upon reaching retirement age, based on the formula set by the plan.

- Transfer value: You might have the option to transfer the value of your pension to a new employer’s scheme or a personal pension plan.

Next Steps:

- Assess your options: Evaluate the pros and cons of each option based on your personal circumstances and future plans.

- Seek professional advice: Consulting a financial advisor can help you make an informed decision tailored to your specific situation.

- Review terms and conditions: Ensure you understand any fees, penalties, and the long-term impact on your retirement benefits before making a decision.

The options available will depend on which type of pension you are in, so it’s crucial to understand the specifics of your pension plan before proceeding.

To determine if transferring your pension when leaving a job is right for you, speak to one of our Financial Advisors, today.

How to transfer an overseas pension to Ireland?

Pension Transfer Options for Irish Residents

Most Irish residents under the age of 70 are eligible to transfer their pensions, with some restrictions. If you have worked in the UK during your career, you likely have a pension pot there. If you plan to move back to Ireland or have already done so, you can transfer your UK pension to Ireland through a Qualified Recognised Overseas Pension Scheme (QROPS) Buy Out Bond. This provides more control over your investment options both now and in retirement.

MyPension can organise a QROPS transfer to bring your UK pension to Ireland. Transferring your pension to Ireland is often ideal because it is more convenient to have your pension in your home country and currency. Additionally, having your pension abroad can increase bureaucracy in future operations such as inheritance planning.

Important Note: If the scheme to which you are considering transferring your pension savings is not a QROPS, your UK pension scheme may refuse to make the transfer, or you may have to pay at least 40% tax on the transfer.

What is QROPS?

A Qualifying Recognized Overseas Pension Scheme (QROPS) is a pension scheme that is allowed to receive a transfer of UK pension benefits free of tax. QROPS offers a retirement opportunity for Irish nationals who have paid into a UK pension and now want to transfer their pension to Ireland. It is also beneficial for UK nationals concerned about the effects of Brexit on their pension, as it helps safeguard personal retirement savings against the increasingly restrictive UK pensions regime.

Benefits of QROPS

- Control: Greater control over your pension investment.

- Tax: A QROPS can accept pension transfers from the UK without potentially triggering a tax charge.

- Convenience: Easier to manage if you plan to retire in Ireland. If you leave your pension in the UK, you will need to submit an annual tax return in Ireland declaring your income from the UK. Transferring your pension to Ireland allows you to work with a financial advisor familiar with the Irish market.

- Inheritance Planning: If your will beneficiaries or dependents are not in the UK, transferring your pension to Ireland simplifies future dealings in the event of your death.

- Standard Fund Threshold (SFT): Any pension savings transferred to a QROPS in Ireland do not count towards the €2 million SFT, which is the maximum pension amount you can save in Ireland without heavy tax charges. The SFT only considers pension savings related to Irish earnings.

How Does QROPS Affect My Tax-Free Lump Sum?

The tax-free lump sum you claim from your QROPS is part of your lifetime limit in Ireland. It will be included in your €200,000 tax-free lump sum limit (and an optional €300,000 taxable lump sum taxed at the standard rate of tax). If your total pension fund at retirement exceeds €800,000 (including both your UK and Irish pensions), the excess in the lump sum over €200,000 will be taxed in Ireland at 20%, whereas it could be tax-free in the UK.

By transferring your UK pension to a QROPS, you gain flexibility, control, and potential tax advantages, making it a favourable option for many who plan to retire in Ireland.

To organise a QROPS transfer, speak with one of our Financial Advisors, today.

How can I transfer old pensions?

Transferring your pension involves significant administrative work, which MyPension can assist with. However, it’s crucial to stay fully informed at every step of the process.

- Determine Your Transfer Value: The first step is to know your transfer value, which is the total amount accumulated in your pension pot over your working life. Your current provider can supply this information. You will receive a document outlining:

- Your transfer value

- Details of any benefits accrued

- Potential costs of transferring (such as exit fees and charges)

- Technical information needed for the transfer

- Application Process: Your new provider will have an application process to initiate the transfer, typically involving forms that need to be completed. While this can often be done online, some cases may require physical forms to be returned to the new provider.

- Permissions and Forms: These forms will grant your new provider permission to contact your current provider to start the transfer process. Your current provider may also require you to complete additional forms and will inform you of any charges or penalties for transferring out of their scheme.

- Transfer Timeline: Once all paperwork is submitted, the transfer process typically takes around six weeks but can sometimes take longer. The duration depends on the efficiency of both providers and the timely exchange of information.

- Investment Continuity: During the transfer period, you remain invested, so you do not lose any pension periods. The continuity ensures that your pension continues to grow or accumulate during the transfer.

By understanding these steps and collaborating with both your current and new providers, you can ensure a smooth and informed transfer process.

Our team of Qualified Financial Advisors and Pension Administrators are there to facilitate and advise you, every step of the way. To determine whether you should transfer your pension(s), speak with one of our Financial Advisors, today.

Are pension transfers taxable?

You can transfer your pension from one recognised provider to another without affecting the tax status of your pension. However, if you transfer your pension pot elsewhere or take a lump sum before the transfer, it will be considered an unauthorised transfer and will be taxed accordingly.

Key Points Regarding Pension Transfers and Tax in Ireland

- Authorised Transfers: Moving your pension from one recognised provider to another does not affect the tax status of your pension.

- Unauthorised Transfers: Transferring your pension pot to a non-recognised provider or taking a lump sum before the transfer will be taxed as an unauthorised transfer.

Tax Implications for Pension Lump Sums

- Tax-Free Lump Sum: In Ireland, you can take a maximum of €200,000 as a tax-free pension lump sum in your lifetime.

- Tax on Lump Sums Over €200,000:

- Amounts between €200,000 and €500,000 are taxed at 20%.

- Any amount exceeding €500,000 is taxed at your marginal rate.

Summary

It’s essential to ensure that your pension transfer is to a recognised provider to avoid tax penalties. Additionally, be aware of the tax-free limits and the applicable tax rates on pension lump sums in Ireland to effectively plan your retirement finances.

Can I transfer my pension myself?

Yes. You can transfer your pension from one recognised provider to another without affecting the tax status of your pension. However, if you transfer your pension pot to a non-recognised provider or take a lump sum before the transfer, it will be considered an unauthorised transfer and will be taxed accordingly.

How much does it cost to transfer a pension?

This varies plan to plan; however, the costs will be set out for you to see and your Financial Advisor will help determine the costs of your current plan vs. proposed. These costs may be outweighed by the benefits offered by your new provider. To ensure that you benefit from the transfer, you need to determine your current provider’s exit costs. These costs can include a penalty for transferring, often called an exit fee, which is usually a percentage of your total value.

Your Financial Advisor will help you understand costs associated with transferring your pension and what the potential new plan fees are, so you can make an informed decision, backed by Financial Advice. This isn’t a process you will have to navigate alone, MyPension is here to help you every step of the way, providing the right advice for you.

To determine whether pension transfer is right for you, speak with one of our Financial Advisors, today.

Take control of your retirement, with MyPension

View all your pensions in one place. MyPension allows you to easily manage your pensions, with features such as combining, contributing and making withdrawals. Your pension, in the palm of your hands.

Cathedral Financial Consultants Ltd t/a My Pension is regulated by the Central Bank of Ireland. With pension investments, your funds might fluctuate in line with investment market movements.

Client services

© Copyright 2024 Cathedral Financial Consultants Ltd t/a My Pension. Registered in Ireland No: 369995.