Contribute your way

If you want to contribute to your pension either one-off or regular (monthly) contributions, simply select “contribute”, to start the process.

Backed by Financial Advice

Our Financial Advisors can provide you with the best advice to contribute to your pension, tax efficiently.

Making contributions is easy

We’ve automated this process to make it as seamless as possible. Select the pension you want to make a contribution towards and let us know amount/ frequency.

One of our Financial Advisors will then be in contact to take you through the process. When you top up your pension, there will be a period of time for the provider to update systems before this will display.

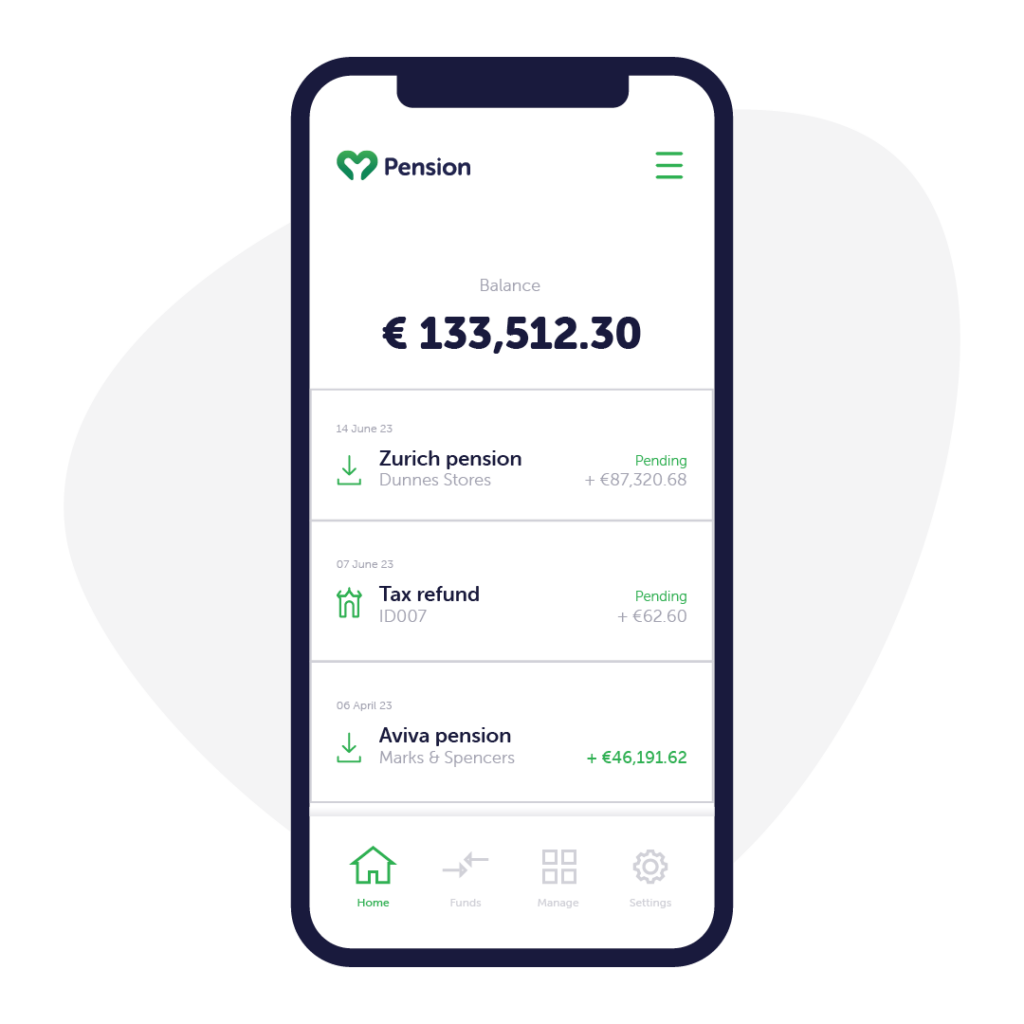

Plan ahead with our pension calculator

Our pension calculator can help you plan how much to save into your pension, so you can look forward to a happy retirement.

Switch your pension plan...

Your pension is protected, every step of the way.

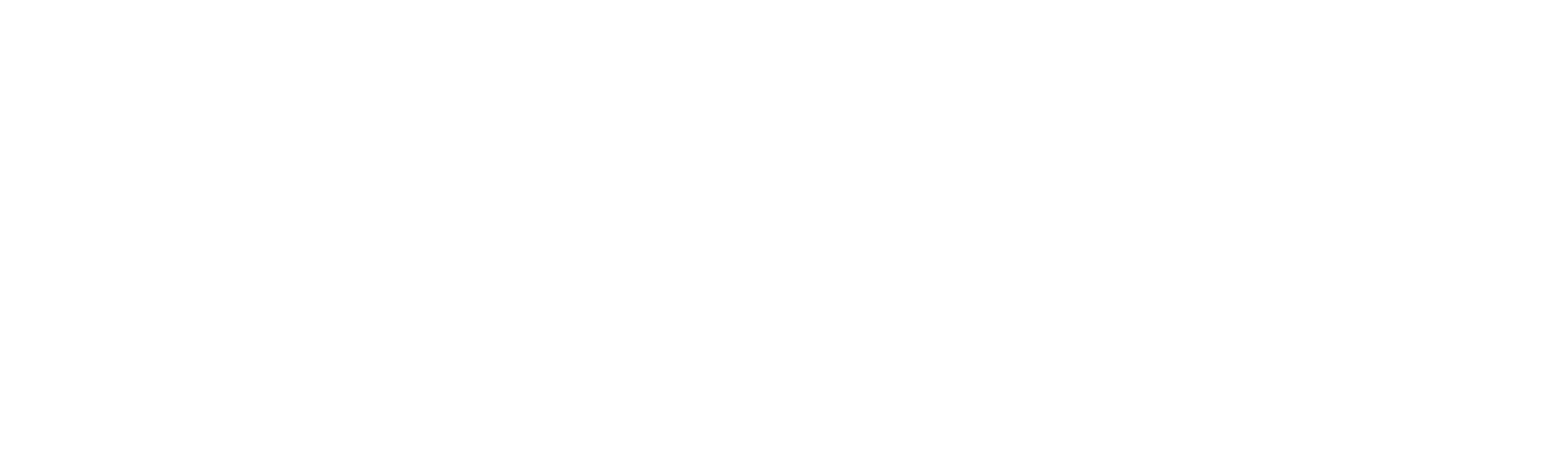

Experienced money managers

Our pension funds are managed by some of the largest and most experienced money managers in Ireland, including Zurich, Aviva, New Ireland, Irish Life, Royal London and Standard Life.

High-grade security

We protect your data with up-to-date technology and processes. All of your information is stored securely within our database.

Permission-only data sharing

We'll never share your personal information with anyone without your permission. Our systems and processes are set up to adhere to the EU General Data Protection Regulation (EU GDPR).

.

Cathedral Financial Consultants Ltd t/a My Pension is regulated by the Central Bank of Ireland. With pension investments, your funds might fluctuate in line with investment market movements.

Client services

© Copyright 2025 Cathedral Financial Consultants Ltd t/a My Pension. Registered in Ireland No: 369995.

Secure identity checks

Secure identity checks