Transferring Your UK Pension to Ireland

MyPension can organise a QROPS transfer to bring your UK pension to Ireland. Transferring your pension to Ireland is often ideal because it is more convenient to have your pension in your home country and currency. Additionally, having your pension abroad can increase bureaucracy in future operations such as inheritance planning.

What’s in this guide?

What type of pension can I transfer?

Why Transfer your UK Pension to Ireland?

Understanding the Transfer Process

What are the benefits of Transferring a UK Pension to Ireland?

Things to consider before transferring

Step-by-step guide to transferring your pension

Costs and Duration of Pension Transfers

What are my retirement options once I’ve transferred my UK pension to Ireland?

Useful Links / Documents

Common Questions about Transferring your UK Pension to Ireland (FAQ)

What type of pension can I transfer?

A Qualified Recognised Overseas Pension Scheme (QROPS) is a type of pension product registered with HMRC in the UK. It can accept pension transfers from the UK without the potential for triggering a tax charge.

Why Transfer your UK Pension to Ireland?

There are several reasons why you might choose to move your UK pensions to Ireland:

- More Control: Greater control of your pension.

- Inheritance planning: Transferring your pension to Ireland could make Inheritance planning easier.

- Better Benefits: Transferring your pension might allow you to take advantage of better benefits offered by another provider.

- High Fees: You might seek a new provider to reduce the fees associated with your current pension, aiming to save on costs.

- Returning Home: If you have worked abroad, you might want to return to your home country and bring your pension with you.

- Plan Closure: Your current pension plan may be closing, either by your employer or the pension provider, prompting the need for a transfer.

- Moving Abroad: Planning to move abroad might require transferring your pension to align with the new country’s pension system.

Understanding the Transfer Process

Pension Transfer Options for Irish Residents

Most Irish residents under the age of 70 are eligible to transfer their pensions, with some restrictions. If you have worked in the UK during your career, you likely have a pension pot there. If you plan to move back to Ireland or have already done so, you can transfer your UK pension to Ireland through a Qualified Recognised Overseas Pension Scheme (QROPS) Buy Out Bond. This provides more control over your investment options both now and in retirement.

MyPension can organize a QROPS transfer to bring your UK pension to Ireland. Transferring your pension to Ireland is often ideal because it is more convenient to have your pension in your home country and currency. Additionally, having your pension abroad can increase bureaucracy in future operations such as inheritance planning.

Important Note: If the scheme to which you are considering transferring your pension savings is not a QROPS, your UK pension scheme may refuse to make the transfer, or you may have to pay at least 40% tax on the transfer.

What is QROPS?

A Qualifying Recognized Overseas Pension Scheme (QROPS) is a pension scheme that is allowed to receive a transfer of UK pension benefits free of tax. QROPS offers a retirement opportunity for Irish nationals who have paid into a UK pension and now want to transfer their pension to Ireland. It is also beneficial for UK nationals concerned about the effects of Brexit on their pension, as it helps safeguard personal retirement savings against the increasingly restrictive UK pensions regime.

What are the benefits of Transferring a UK Pension to Ireland?

Benefits of QROPS

- Control: Greater control over your pension investment.

- Tax: A QROPS can accept pension transfers from the UK without potentially triggering a tax charge.

- Convenience: Easier to manage if you plan to retire in Ireland. If you leave your pension in the UK, you will need to submit an annual tax return in Ireland declaring your income from the UK. Transferring your pension to Ireland allows you to work with a financial advisor familiar with the Irish market.

- Inheritance Planning: If your will beneficiaries or dependents are not in the UK, transferring your pension to Ireland simplifies future dealings in the event of your death.

- Standard Fund Threshold (SFT): Any pension savings transferred to a QROPS in Ireland do not count towards the €2 million SFT, which is the maximum pension amount you can save in Ireland without heavy tax charges. The SFT only considers pension savings related to Irish earnings.

To organize a QROPS transfer, speak with one of our financial advisors today.

of a financial advisor can help you make an informed decision about transferring your pension. To find out if you should transfer your plans, speak with one of our Financial Advisors, today.

Things to consider before transferring

- When transferring your pension, ensure it goes to a scheme registered with HMRC as a Qualifying Recognised Overseas Pension Scheme (QROPS) to avoid potential UK tax charges of up to 55%.

- The minimum retirement age under a QROPS is 55, with exceptions only for ill health.

- Your tax residency status matters. If you’ve been a UK resident within the last 5/10 tax years, you may be subject to UK tax on your QROPS upon retirement.

- For QROPS transfers, benefits can be accessed if you’re aged 55 or over and have not been a UK tax resident for at least 10 tax years.

- An overseas transfer charge of 25% applies to QROPS transfers, except for certain scenarios like transfers to your employer’s occupational pension scheme, your country of residence, or within the European Economic Area.

- Both the UK and Ireland impose limits on pension savings, known as the Lifetime Allowance in the UK and the Standard Fund Threshold in Ireland. Exceeding these limits may result in tax liability.

- Consider the value of your pension concerning the Lifetime Allowance.

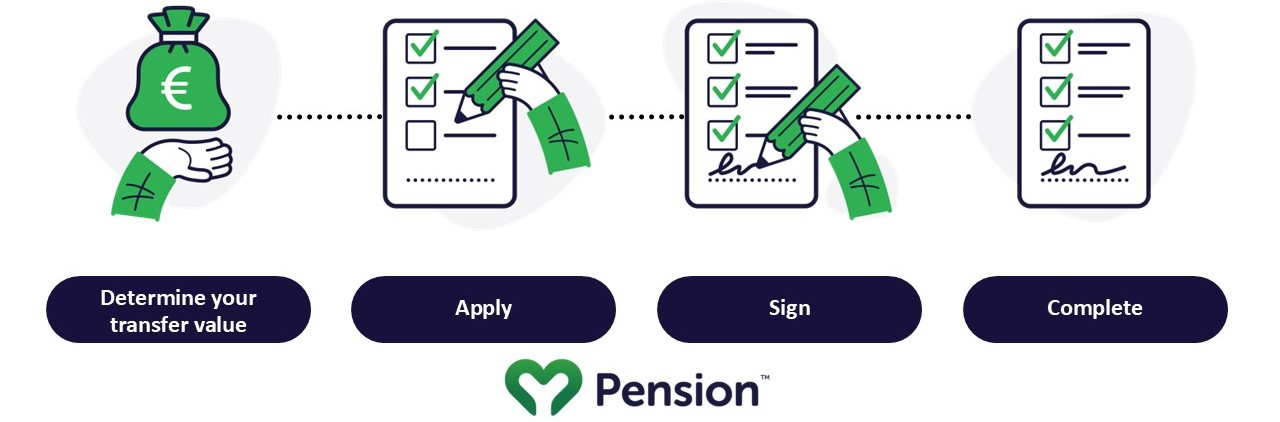

Step-by-step guide to transferring your pension

Step 1: Sign-up to MyPension

- Sign-up to MyPension

- Add a pension via the MyPension dashboard: When you add your UK pension and sign the transfer of agency document, you will automatically be assigned a Financial Advisor who will arrange a meeting to discuss your pension transfer options.

- Contact Your UK Provider: Reach out to your UK pension provider to request a transfer options form.

- Include Overseas Transfer Option: Ensure that the form includes the option to transfer your pension overseas.

Following these steps will help you initiate the process of transferring your UK pension to Ireland using a QROPS, providing you with greater control and potential tax benefits for your retirement savings.

To determine whether pension transfer is right for you, speak with one of our Financial Advisors, today.

Costs and Duration of Pension Transfers

The duration of a QROPS depends largely on the information provided.

If you have already reached out to your UK pension provider and requested a transfer options for including overseas transfers, the process would typically take 2-3 months from speaking with a Financial Advisor to transfer complete. There are several factors that could impact this however (duration of time spent in the UK, tax residency status, etc.).

The cost of a QROPS transfer from UK to Ireland is free from tax, provided certain conditions are met.

There’s a 25% overseas transfer fee for QROPS unless you are transferring to:

- your employers occupational pension scheme

- your country of residence (Ireland in this case)

- European Economic Area (EEA)

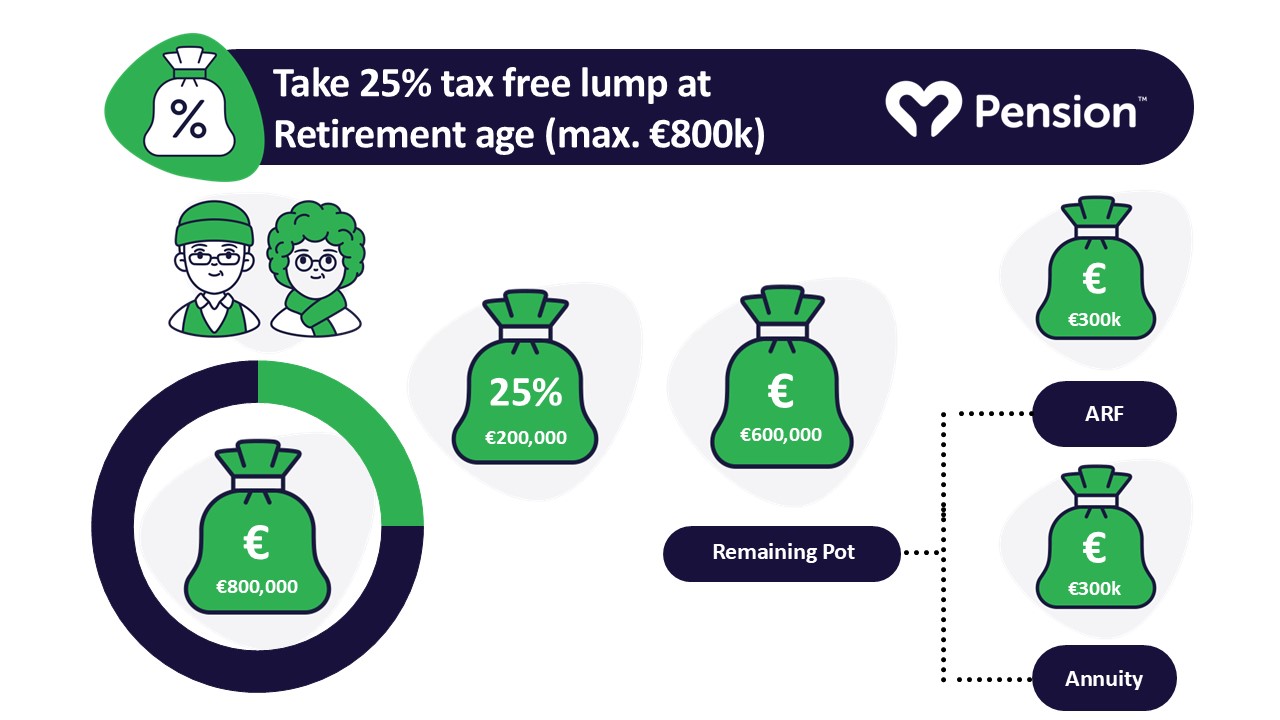

What are my retirement options once I’ve transferred my UK pension to Ireland?

Retirement options in Ireland:

- Tax-free lump sum of 25%: up to a maximum lifetime limit of €200,000

- Approved Retirement Fund (ARF): You can choose to invest the remaining balance in an Approved Retirement Fund (ARF), allowing the balance of your fund to have the potential to grow tax free, while accessing your pension.

- Annuity: Alternatively, you may opt to purchase an annuity, which provides a regular income stream for life or a specified period

- Taxable Lump Sum: Another option is to take the remaining balance as a taxable lump sum, subject to taxation according to applicable laws and regulations.

Useful Links / Documents

Pension Calculator

Find out your likely retirement income.

Find your old Workplace Pensions

Sign-up and find all of your pensions.

Common Questions about Transferring your UK Pension to Ireland (FAQ)

Are the rules of transfer governed by the UK or Ireland?

The UK permits transfers to overseas schemes recognised as ‘QROPS’ (Qualifying Recognised Overseas Pension Scheme). Requests for transfers may undergo assessment for tax purposes by both the scheme administrator and the UK’s tax authorities.

If the scheme you’re considering for transferring your pension savings is not recognized as a QROPS, your UK pension scheme may decline the transfer request, or you may be liable to pay tax of at least 40% on the transfer amount.

What is a Qualified Recognised Overseas Pension Scheme? (QROPS)

A Qualified Recognised Overseas Pension Scheme (QROPS) is a type of pension product registered with HMRC in the UK. It can accept pension transfers from the UK without the potential for triggering a tax charge.

Can I move my UK State pension using a QROPS?

No. The QROPS is tailored for transferring defined benefit pensions, defined contribution pensions, self-invested personal pensions (SIPP), and self-administered pensions (SSAS) exclusively, and cannot be utilised for transferring the State pension to another jurisdiction.

Is QROPS my only option?

No. However, other options could trigger paying up to 55% tax on the value transferred. QROPS was introduced to reduce this tax to a maximum of 25%, and in some cases without any tax charges when certain conditions are met.

Do I pay tax on moving my UK pension to Ireland?

The cost of a QROPS transfer from UK to Ireland is free from tax, provided certain conditions are met.

There’s a 25% overseas transfer fee for QROPS unless you are transferring to:

- your employers occupational pension scheme

- your country of residence (Ireland in this case)

- European Economic Area (EEA)

How much does it cost to transfer a UK pension to Ireland?

The cost of a QROPS transfer from UK to Ireland is free from tax, provided certain conditions are met.

There’s a 25% overseas transfer fee for QROPS unless you are transferring to:

- your employers occupational pension scheme

- your country of residence (Ireland in this case)

- European Economic Area (EEA)

Take control of your retirement, with MyPension

View all your pensions in one place. MyPension allows you to easily manage your pensions, with features such as combining, contributing and making withdrawals. Your pension, in the palm of your hands.

Cathedral Financial Consultants Ltd t/a My Pension is regulated by the Central Bank of Ireland. With pension investments, your funds might fluctuate in line with investment market movements.

Client services

© Copyright 2024 Cathedral Financial Consultants Ltd t/a My Pension. Registered in Ireland No: 369995.