How do I find a lost pension?

It’s estimated that approximately €500m pension benefits go unclaimed in Ireland. Our Pension Tracing service can help you to find all your pensions, with just some basic information.

What’s in this guide?

How are pensions lost?

How to trace lost pension?

Found your lost pension. What’s next?

Should I transfer old pensions into a new plan?

Useful Links / Documents

Common Questions about Finding your Pension in Ireland (FAQ)

How are pensions lost?

It’s estimated that €500m pension benefits in Ireland are unclaimed. Locating all pensions allows you better visibility for planning your retirement and more control. Ultimately, it means you can drawdown on all your pensions in retirement. Our Pension Tracing Services help locate your lost pensions, that you can view online in one place. Sign-up to My Pension and start the process today.

How to trace lost pension?

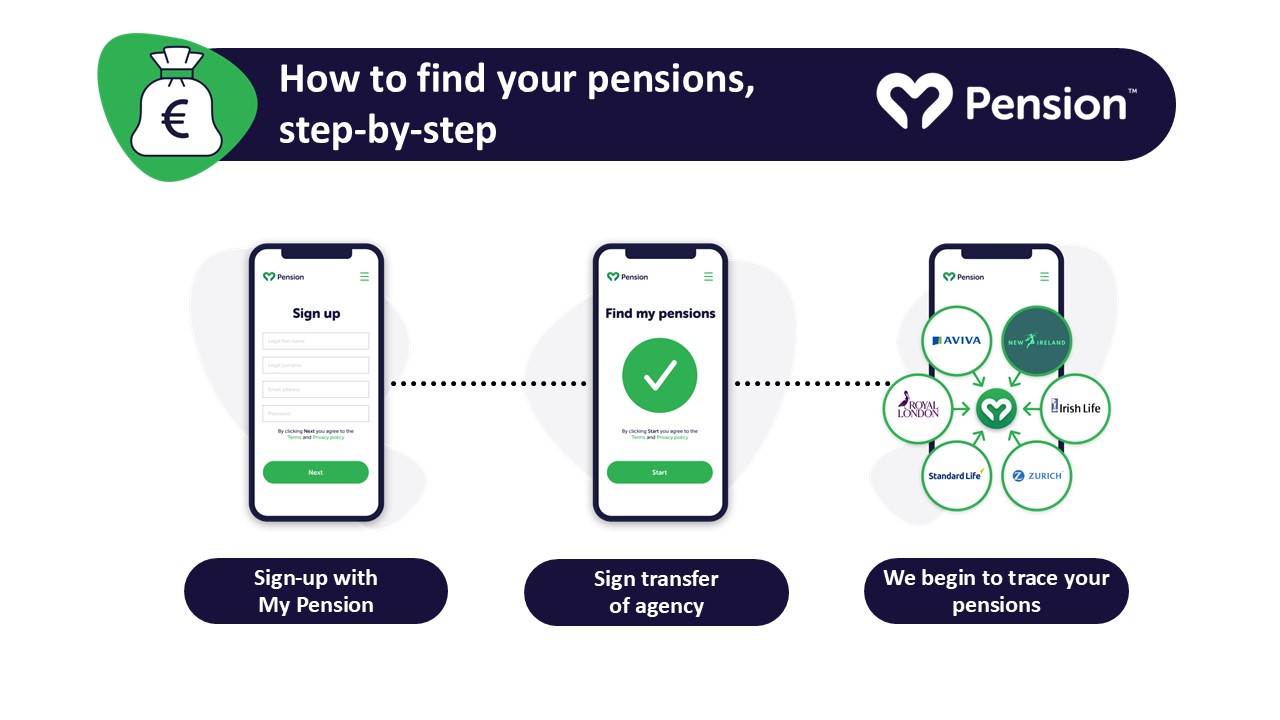

The first steps to finding your lost pension are:

- Sign-up to MyPension. Here, you will input some basic details such as name, date of birth, address, etc.

- We will then issue a Transfer of Agency (TOA) document that will require a signature (you can do this online during the sign-up process). The TOA provides us with permission to obtain records from the life companies regarding your pension(s).

That’s all we initially need to start searching. We right to the pension providers and request that they send us your pension details for any and all that they have for you.

If nothing comes back, it might be that the pension was under a different name (such as maiden name), or a previous address, so we might look to find out more specific information to look further into where your pension(s) might be.

The more information you give us, the easier it will be to locate, such as previous employment, etc.

Found your lost pension. What’s next?

Once we have successfully located your pensions, you will be able to access and manage your pensions online, using MyPension.ie or our mobile App.

This is particularly useful as you can gain access to your pension balance 24/7, as well as policy information (providers, number, amounts, etc.). You can also manage your pensions with helpful features such as switching pension plans, accessing withdrawals and use our useful tools such as our pension calculator to ensure you’re on track to reach your retirement goals.

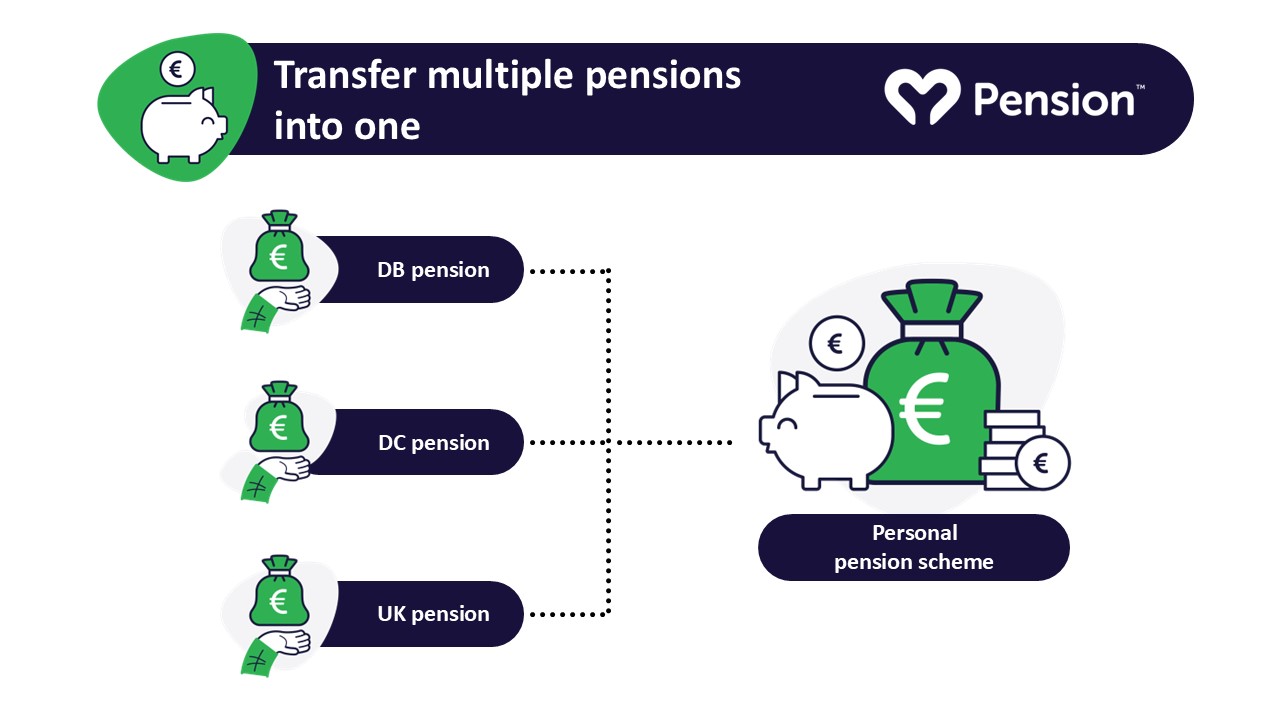

Should I transfer old pensions into a new plan?

There are several reasons why you might choose to move your pensions between providers:

- Consolidation: If you have worked for multiple companies, you may have accumulated several pensions. Combining them into one new pension plan can simplify your financial management.

- Better Benefits: Transferring your pension might allow you to take advantage of better benefits offered by another provider.

- High Fees: You might seek a new provider to reduce the fees associated with your current pension, aiming to save on costs.

- Returning Home: If you have worked abroad, you might want to return to your home country and bring your pension with you.

- Plan Closure: Your current pension plan may be closing, either by your employer or the pension provider, prompting the need for a transfer.

- Moving Abroad: Planning to move abroad might require transferring your pension to align with the new country’s pension system.

Contact us today to disucss your options.

Useful Links / Documents

Pension Calculator

Find out your likely retirement income.

Find your old Workplace Pensions

Sign-up and find all of your pensions.

Common Questions about Finding your Pension in Ireland (FAQ)

How can I find out if I have a pension from a previous job?

Contacting your old employer or HR department to give you information on your old workplace pension, or checking old pay slips is a simple way of determining whether or not you had a workplace pension at your previous employment.

MyPension offers a free pension tracing service to help locate your lost pensions, so sign-up today and we can help provide you with necessary arrangements to help locate lost pensions.

What is the quickest way to find lost pensions?

The first steps to finding your lost pension are:

- Sign-up to MyPension. Here, you will input some basic details such as name, date of birth, address, etc.

- We will then issue a Transfer of Agency (TOA) document that will require a signature (you can do this online during the sign-up process). The TOA provides us with permission to obtain records from the life companies regarding your pension(s).

That’s all we initially need to start searching. We right to the pension providers and request that they send us your pension details for any and all that they have for you.

If nothing comes back, it might be that the pension was under a different name (such as maiden name), or a previous address, so we might look to find out more specific information to look further into where your pension(s) might be. It’s also worth contacting your old employer or HR department to give you information on your old workplace pension, or checking old pay slips.

The more information you give us, the easier it will be to locate, such as previous employment, etc.

Should I combine all my old pensions into one?

We wouldn’t necessarily advise you to combine all pensions into one pot, as MyPension allows you the visibility and flexibility of seeing all pensions in one place without the need to combine; however, you might want to switch your pension plan(s), dependant on benefits and performance, as well as attitude to risk and other factors our Financial Advisors can talk you through.

To see if you should switch, contact one of our Financial Advisors, today.

What happens to lost pensions that aren't claimed?

In general, your pension will still exist, but if you don’t locate your pension you won’t be able to access it. On death, pensions go to your estate; however, again, if your pension is not located, your estate will not know about it and it will remained un-accessed. It’s estimated that approximately €500m in pension benefits go unclaimed in Ireland.

Can I manage my pensions online?

Yes, MyPension.ie allows you to view all your pensions in one place. This is particularly useful as you can gain access to your pension balance 24/7, as well as policy information (providers, number, amounts, etc.). You can also manage your pensions with helpful features such as switching pension plans, accessing withdrawals and use our useful tools such as our pension calculator to ensure you’re on track to reach your retirement goals.

Take control of your retirement, with MyPension

View all your pensions in one place. MyPension allows you to easily manage your pensions, with features such as combining, contributing and making withdrawals. Your pension, in the palm of your hands.

Cathedral Financial Consultants Ltd t/a My Pension is regulated by the Central Bank of Ireland. With pension investments, your funds might fluctuate in line with investment market movements.

Client services

© Copyright 2024 Cathedral Financial Consultants Ltd t/a My Pension. Registered in Ireland No: 369995.