Personal Pension in Ireland

A personal pension plan in Ireland serves as a retirement savings vehicle, allowing you to contribute either periodically or in a single lump sum. These contributions are subsequently invested, in assets such as the stock market, with the objective of growing your pension fund to provide income during your retirement years.

What’s in this guide?

What is a personal pension?

How do personal pensions work?

Is a personal pension right for you?

Personal pension tax relief

Taking money from your pension

Useful Links / Documents

Common Questions about Personal Pensions in Ireland (FAQ)

What is a personal pension?

A personal pension is an individually owned retirement fund, registered under your name. Unlike a corporate/ workplace pension scheme where your employer might contribute to your pension, with a personal pension, only you have the ability to make contributions.

How do personal pensions work?

Personal Pension Plans (PPPs) are typically offered by insurance companies and can be acquired via MyPension. With numerous PPP options available, selecting the most suitable one can pose a challenge. Our Advisors are always happy to help determine a pension to help you achieve your retirement goals.

When you select a fund and make a contribution, the insurance company will allocate your funds into one or multiple investment vehicles, that they believe will yield optimal returns throughout the duration of the PPP. Some assets an insurance company might invest in on your behalf are shares in diverse companies, government bonds, and investing in real estate.

The insurance company will then deduct various charges from your contributions. These charges may include setup fees, allocation rates, bid/offer charges, fund management fees, fund switching fees, etc. Many of these charges are deducted from your fund and can impact the value of your pension. These charges will be clearly defined in the key features document, and your Financial Advisor can help you to calculate charges so you can understand the return to expect based on annual yield assumptions.

Is a personal pension right for you?

PPPs can be taken out by:

- Someone who is self-employed

- Employees who don’t have access to an occupational pension scheme.

and;

- Have a taxable income for the relevant tax year.

Personal pension tax relief

The maximum income tax relief you can receive on your pension contributions in Ireland is based on your marginal income tax rate, which is either 40% for top-rate taxpayers or 20% for standard-rate taxpayers.

For instance, if you invest €100 into a regular savings plan, it would cost you €100. However, if you allocate the same amount to a pension plan, it could only cost you €80 if you’re a standard-rate taxpayer or €60 if you’re a top-rate taxpayer.

There are limits on income tax relief for pension contributions, meaning there’s a cap on the amount you can contribute annually while still being eligible for tax relief. This cap is determined by your age and is expressed as a percentage of your gross taxable income, with the maximum gross income figure for relief purposes set at €115,000.

It’s important to note that pension income in retirement is subject to taxation.

Taking money from your pension

Upon retirement, if your Personal Pension Plan (PPP) has performed well, you’ll have accrued a lump sum in your PPP fund. This lump sum comprises your monthly contributions and any growth resulting from investing your funds in various vehicles, minus applicable charges. However, if the investments within your PPP do not yield any growth during its duration, you may end up with less money than you’ve contributed.

You can access the funds from your pension under the following circumstances:

- Ages 60 to 75: You can withdraw funds from the age of 60 up to age 75. It’s not mandatory to retire or cease working to access the benefits from your PPP. You simply need to be over 60 and under 75.

- Serious Ill Health: You can access your pension at any age in the case of serious illness, typically when you’re permanently unable to work again. This is subject to Revenue approval, and only available in exceptional circumstances.

- Age 50 for Specific Occupations: If your occupation typically involves retirement before the age of 60, such as being a professional athlete like a golfer, rugby player, or jockey, you may access your pension from the age of 50.

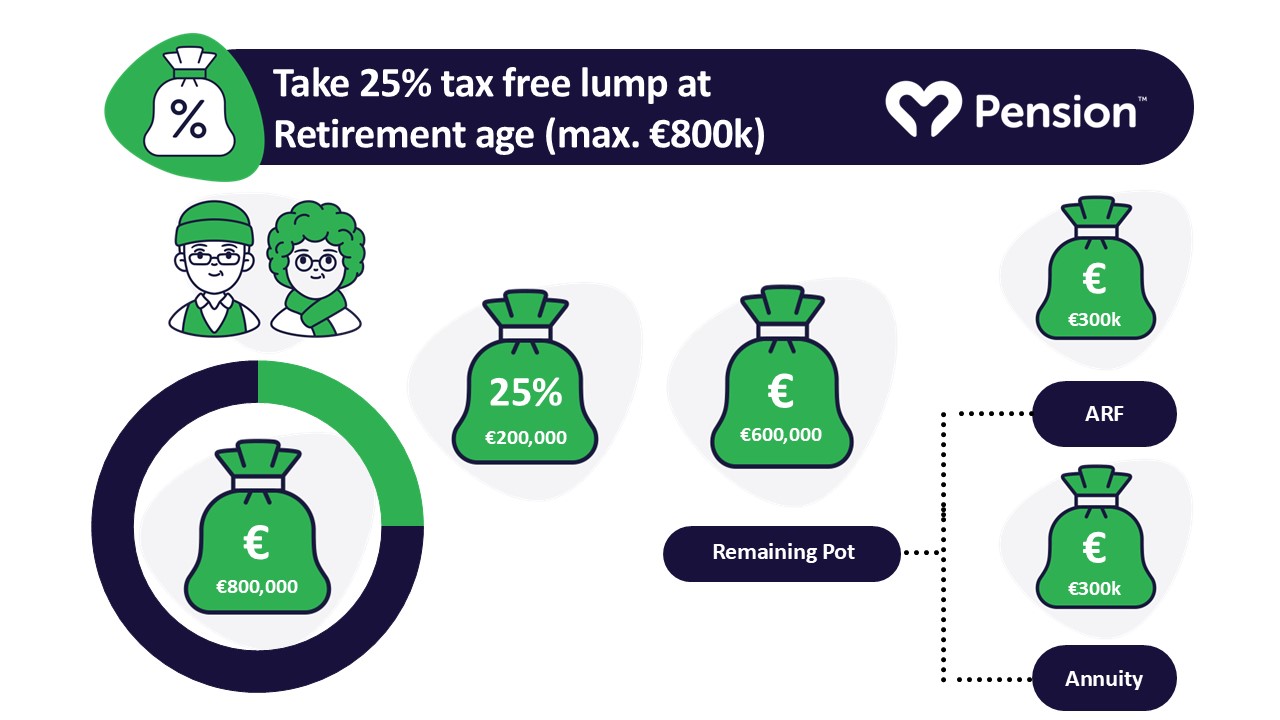

When accessing benefits from your PPP fund, you’ll typically have the option to withdraw a tax-free lump sum of 25%, up to a maximum lifetime limit of €200,000. After this, you have several choices for the remainder of the balance, if any:

- Approved Retirement Fund (ARF): You can choose to invest the remaining balance in an Approved Retirement Fund (ARF), allowing the balance of your fund to have the potential to grow tax free, while accessing your pension.

- Annuity: Alternatively, you may opt to purchase an annuity, which provides a regular income stream for life or a specified period

- Taxable Lump Sum: Another option is to take the remaining balance as a taxable lump sum, subject to taxation according to applicable laws and regulations.

Useful Links / Documents

Pension Calculator

Find out your likely retirement income.

Start a Personal Pension

Sign-up and start a personal pension, today.

Common Questions about Personal Pensions in Ireland (FAQ)

How much can I put into my personal pension?

There are no limits on the amount you can put into your personal pension; however, there are limits on income tax relief for pension contributions, meaning there’s a cap on the amount you can contribute annually while still being eligible for tax relief. This cap is determined by your age and is expressed as a percentage of your gross income, with the maximum gross income figure for relief purposes set at €115,000.

Age |

Percentage of earnings you can contribute |

Under age 30 |

15% |

30 to 39 |

20% |

40 to 49 |

25% |

50 to 54 |

30% |

55 to 59 |

35% |

60 and above |

40% |

Can an employer pay into a personal pension plan

In simple terms, No. A personal pension is a retirement fund owned individually and registered under your name. Unlike corporate or workplace pension schemes where your employer may contribute, with a personal pension, only you have the authority to make contributions.

Employers can however pay into a PRSA (which is another type of retirement plan available to individuals).

What's the difference between a PRSA and a Personal Pension Plan

A Personal Retirement Savings Account (PRSA) functions similarly to a Personal Pension Plan (PPP) as another option for saving for retirement. It operates as an investment account dedicated to retirement savings. Contributions made to a PRSA are tax-deductible within specified limits. Unlike a PPP, you don’t necessarily need to have earned income or paid taxes to open a PRSA.

Employers are required by law to offer access to at least one Standard PRSA if they don’t provide an occupational pension scheme or if certain limits apply to their existing scheme. Contributions to your PRSA can be made by you, your employer alone, or jointly by you and your employer.

There are two types of PRSAs available: standard PRSAs and non-standard PRSAs. The main differences between them are:

Standard (PRSA) |

Non-standard (PRSA) |

| Capped charges | Charges not capped |

| Limited choices of investment funds | Wide range of investment funds |

Can I take my money out if I need it?

The earliest you can withdraw your pension in Ireland is age 50. To be eligible for early withdrawal, you must have a pension with a former employer, an executive pension, or a PRSA, and satisfy a number of specific conditions, (if you want more information on conditions, please contact a financial advisor).

Determining the type of pension you hold and assessing the advantages and disadvantages of transferring it is crucial. We recommend discussing this with one of our Financial Advisors to determine eligibility of pension drawdown and understand the options available.

When accessing your pension, you have the option to take a tax-free lump sum of up to 25%. Here’s what you should keep in mind:

You’re typically allowed to withdraw up to 25% of your pension as a tax-free lump sum, upto a lifetime maximum of €200,000. For instance, if your pension is valued at €800,000, you can immediately withdraw €200,000 tax-free.

When assessing the value of your pension, it’s crucial to determine its type. Defined Benefit (DB) pensions often appear smaller than they actually are on annual statements. For example, if your statement indicates €30,000 per annum, your total pension savings could exceed €450,000.

Understanding the type of pension you have and its value is essential for evaluating whether early pension access is a sensible decision. Contact us today, to find out more.

What happens to a persons pension when they die?

If you die before accessing the benefits from your PPP fund, the value of the fund can be paid into your estate. In order to streamline this process, it’s essential you have an up-to-date, valid Will.

Take control of your retirement, with MyPension

View all your pensions in one place. MyPension allows you to easily manage your pensions, with features such as combining, contributing and making withdrawals. Your pension, in the palm of your hands.

Cathedral Financial Consultants Ltd t/a My Pension is regulated by the Central Bank of Ireland. With pension investments, your funds might fluctuate in line with investment market movements.

Client services

© Copyright 2026 Cathedral Financial Consultants Ltd t/a My Pension. Registered in Ireland No: 369995.