Pension Calculator

Use our pension calculator to determine how much income your pension could generate in retirement.

How to use this pension calculator

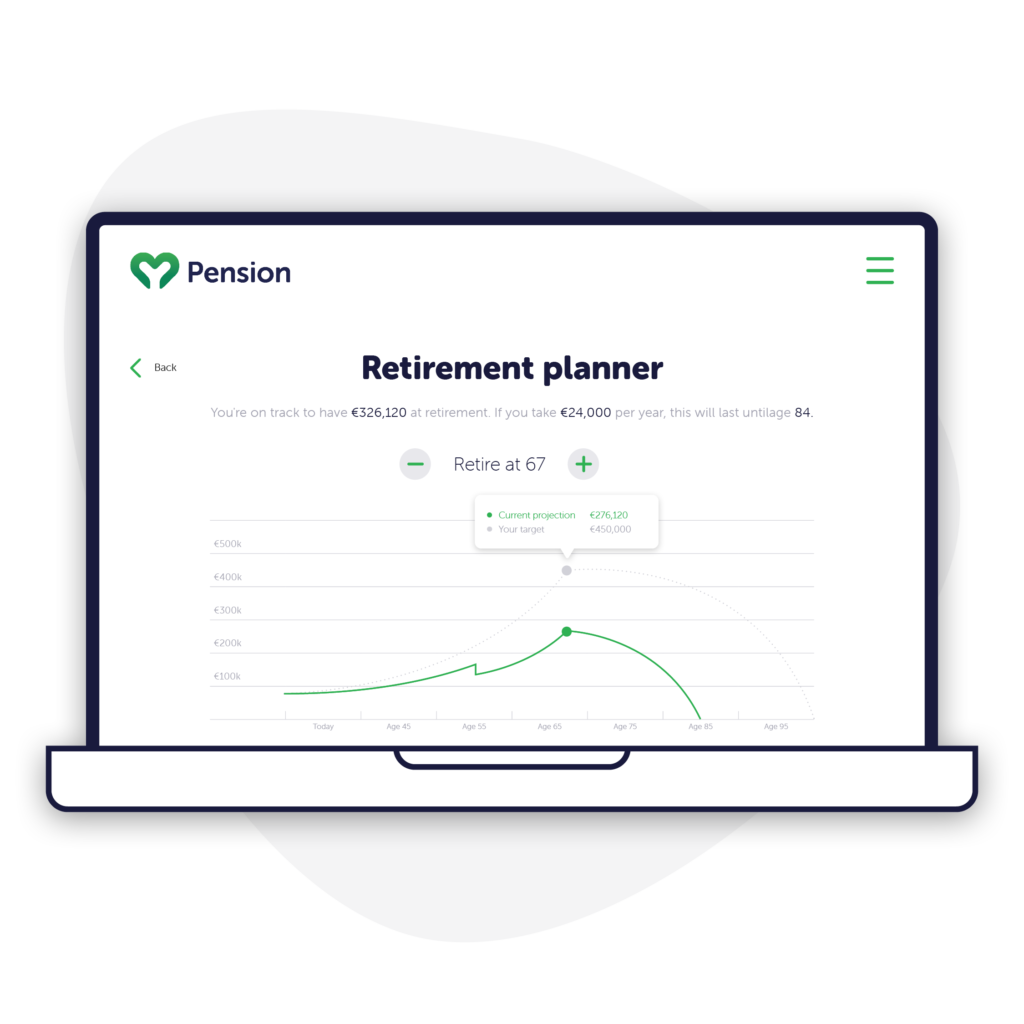

Our Irish pension calculator can be used to help plan youre retirment, by determining how long your pension could last and how contributions might impact your retirement savings. The calculator will help you determine your current projection at retirment, as well as forecast future projections based on inputs such as additional contributions and employer contributions.

Get started by telling us some basic details.

Pension Calculator

You're on track to at retirement. If you take {{ formatPrice(annualRetirementIncome) }} per year, this will last until age .

You're on track to at retirement. If you take {{ formatPrice(annualRetirementIncome) }} per year, this will last until age .

Your details

Current Projection {{ formatPrice(forecast.sum5) }}

Pension calculator FAQs

What are the projection assumptions?

The solid green line indicates your current projection, which assumes investment growth of 5% every year. The light green area either side of this indicates the high or low growth your investments, with our low growth assumptions anticipating growth of 3% every year and our high growth assumptions anticipating growth of 8% every year.

We’ve also assumed inflation of 2.5% per year and one annual management fee of 0.7% taken from your pension each year. When using the personal monthly or one-off contribution sliders, your projection will include the 25% tax top up from Revenue as part of the forecast.

Why do we include an assumed rate of inflation?

When using our retirement planner, you will note that we have included an assumed annual rate of inflation of 2.5% in your pension projection. Inflation is the rate at which the cost of everyday things like food, transport and electricity increases over time. We have used 2.5% as this is the assumed annual rate of inflation used by the Central Bank of Ireland.

A projected annual inflation rate of 2.5% means the purchasing power of your pension reduces by 2.5% each year until your target retirement age. By factoring in this rate of inflation, the projected value of your pension at retirement is shown in real terms. In other words, how much your projected pension amount would be worth today.

If you’d like to better understand how far your savings will go in retirement, speak to your Personal Financial Advisor (issued at sign-up), to find out how your pension could be impacted. If you’re unsure who that is, contact us and we’ll point you in the right direction.

How does taking a 25% tax-free amount work?

Pension withdrawal, also known as drawdown, becomes an option as soon as you reach the age of retirement (in certain circumstances, it’s as early as 50). At this point you can take up to 25% of your pension tax-free – as a lump sum or in portions. In the retirement planner it’s assumed that you’ll take your entire 25% tax-free amount, unless you push this toggle off. Taking a tax-free amount will only impact your current projection.

What are the State Pension assumptions?

We have assumed that you will be eligible for the Full State Pension (Contributory) of €13,800 per year, and that the state pension will provide the same value upon your retirement. We will factor this annual amount into your current projection and target retirement income. In Ireland, the current State Pension age is 66.

How have you worked out my average life expectancy?

Research shows that if the increase in life expectancy continues through the 21st century. With life expectancies steadily increasing like this we have chosen an average of 100 years, as we want to ensure all our savers have sufficient funds during retirement.

What should my desired retirement income be?

Many people aim for a retirement income that’s two thirds of their current salary. For example, if your annual salary is currently €30,000, then €20,000 per year would give you a reasonable retirement income. If you’re likely to be eligible for the Full State Pension (Contributory) (currently €13,800 per year) then you’ll find an option to include this within the retirement planner.

Pension contribution calculation

Our pension contribution calculator takes into account individual contributions and employer (if applicable). The sum will then compound and offer a value over the remaining years to retirement.

Employer contribution calculation

Our employer contribution calculator takes into account both individual contributions and employer contributions (as oulined in your workplace pension plan). The sum will then compound and offer a value over the remaining years to retirement.

Take control of your retirement, with MyPension

View all your pensions in one place. MyPension allows you to easily manage your pensions, with features such as combining, contributing and making withdrawals. Your pension, in the palm of your hands.

Cathedral Financial Consultants Ltd t/a My Pension is regulated by the Central Bank of Ireland. With pension investments, your funds might fluctuate in line with investment market movements.

Client services

© Copyright 2024 Cathedral Financial Consultants Ltd t/a My Pension. Registered in Ireland No: 369995.