Finding My Pension [A Guide to Pension tracing in Ireland]

It’s estimated that approximately €500m pension benefits go unclaimed in Ireland. Our Pension tracing service can help you to find all your pensions, with just some basic information.

What’s in this guide?

Why is it important to locate all your pensions?

Why is it important to trace pensions?

What information do I need to trace my pension?

How can I find my UK pension, in Ireland?

Can someone help me find my pension?

How to find or trace a lost pension?

What happens once my pensions are located?

Useful Links / Documents

Common Questions about Finding your Pension in Ireland (FAQ)

Why is it important to locate all your pensions?

It’s estimated that €500m pension benefits in Ireland are unclaimed. Locating all pensions allows you better visibility for planning your retirement and more control. Ultimately, it means you can drawdown on all your pensions in retirement. It’s easy to lose track or even not know about old pensions that you have from previous employment, overseas pension, changed addresses maiden name, etc. Our Pension tracing services help locate your lost pensions, that you can view online in one place. Whether it’s a UK pension you want to transfer over, over old pensions in Ireland you want to locate, sign-up to MyPension and start the process today.

Why is it important to trace pensions?

It’s not a given that at retirement you will have access to all your pensions. It’s estimated that approximately €500m pension benefits go unclaimed in Ireland. Pensions are something you need to keep track of and locating them is essential. Our Pension tracing service help locate all your pensions, so you can view them in the one place and more importantly, access them.

What information do I need to find my pension?

Our Pension tracing service is simple to start and often doesn’t require much information. We start by taking basic information and a signed Transfer of Agency document. This allows us to write to the pension providers in Ireland on your behalf and request pension information relevant to you, so we can locate your pension. Don’t worry if you don’t have all information, we can get started this way and will inform you should we require different criteria (provider dependant).

How can I find my UK pension, in Ireland?

Find your UK pension whilst living in Ireland. If you have your UK pension details we can look at your options for transferring your UK pension to Ireland. Our Pension tracing service can help you to find your UK pension, and provide information regarding a QROPS transfer to move your UK pension to Ireland.

Contact us today to discuss your options and start tracking down lost pensions.

Can someone help me find my pension?

Absolutely, when it comes to finding old pensions, we’re here to help. Our mission is to reduce the estimated €500m unclaimed pension benefits in Ireland, by locating all pensions. Simply sign-up today to get started, it’s that simple.

On sign-up, you will be presented with basic information to complete (Name, DOB, etc.), and a transfer of agency (TOA) document which can be signed online. This signed document allows us to write to providers and request what pensions you have with them. Failure to yield results that way, we might request more information to help hone in on where your pensions might be, but we’re here to help find your lost pensions and provide visibility and management tools via our online service.

Find Your Pensions

Find old pensions and view online.

How to find or trace a lost pension?

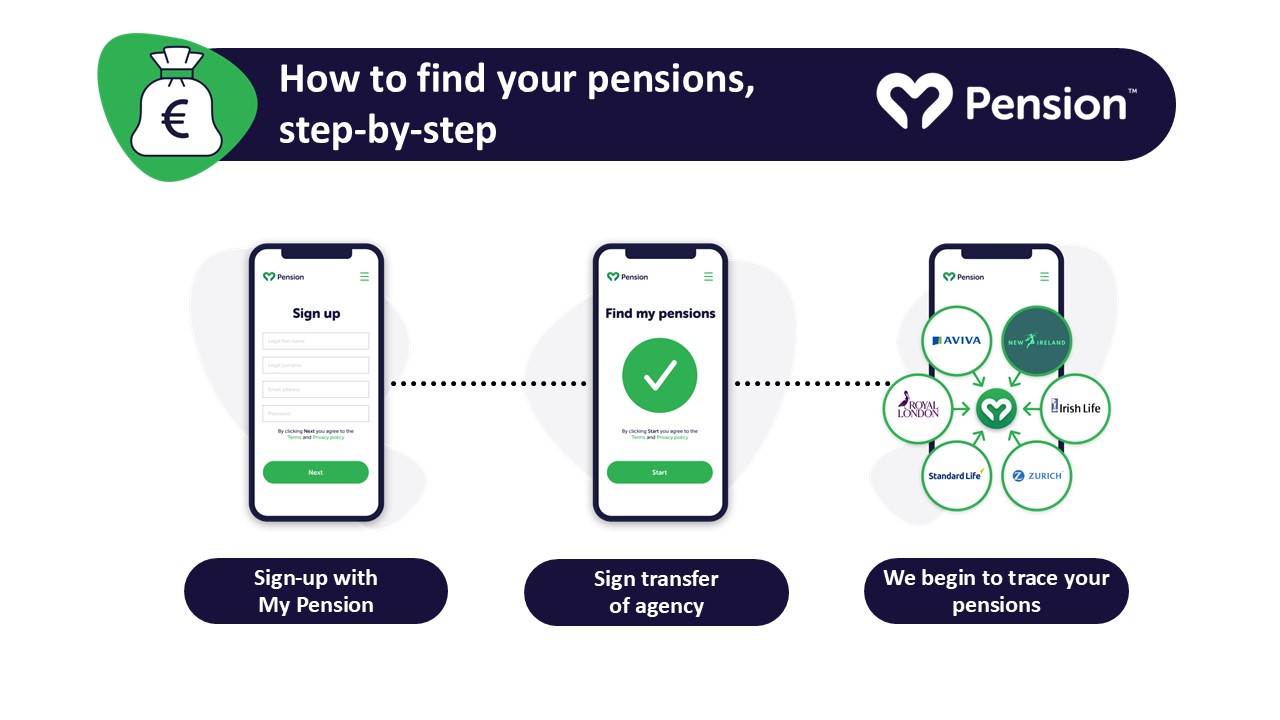

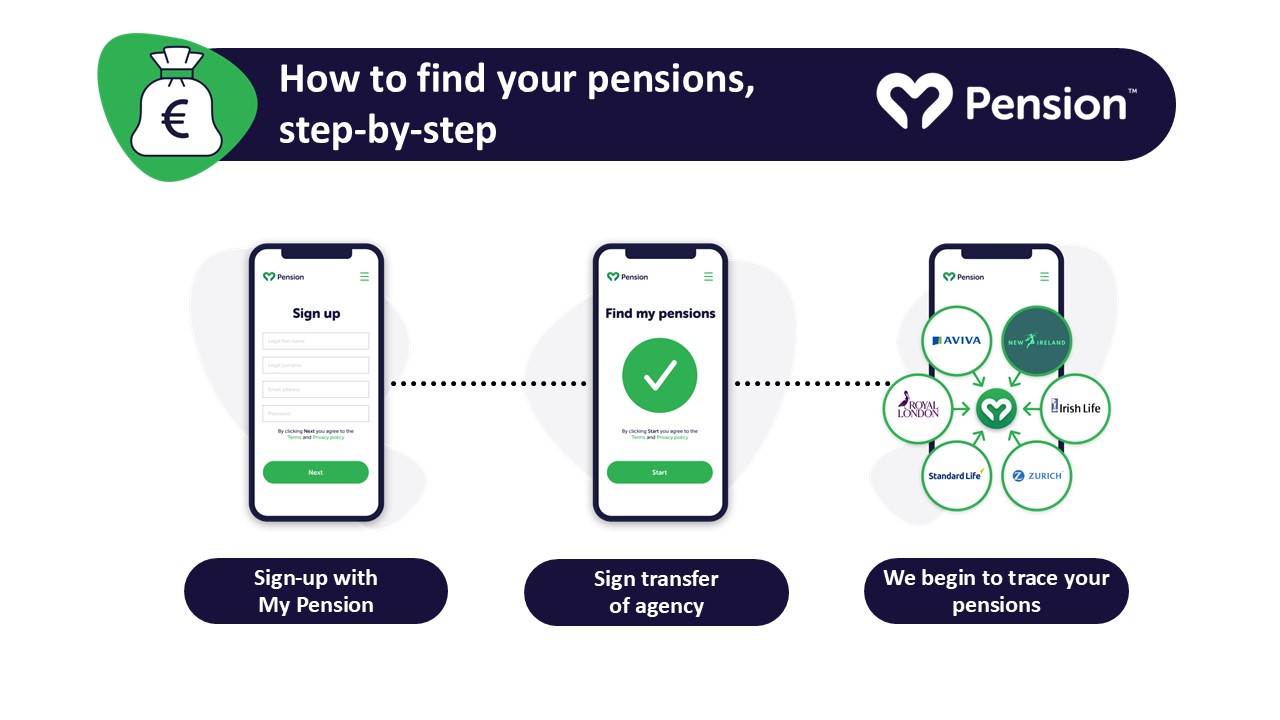

The first steps to finding your lost pension are:

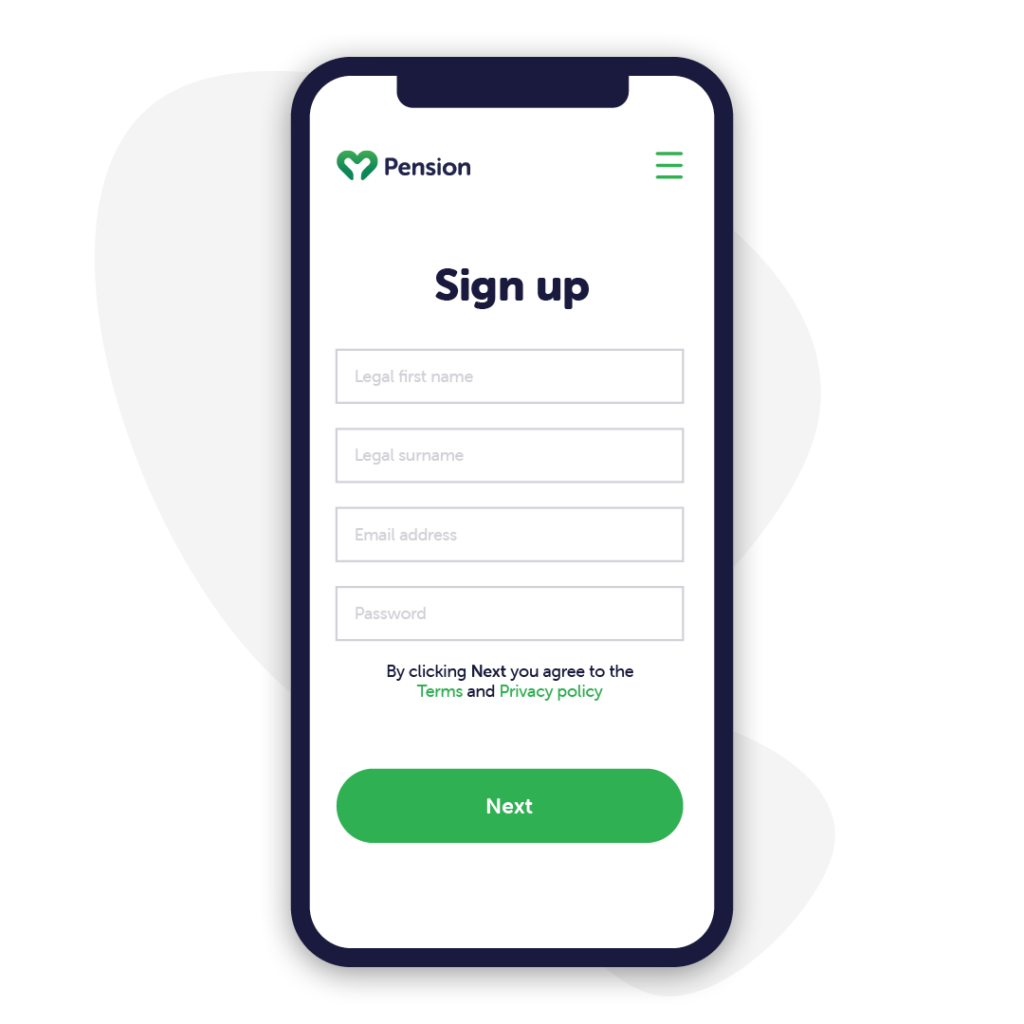

- Sign-up to MyPension. Here, you will input some basic details such as name, date of birth, address, etc.

- We will then issue a Transfer of Agency (TOA) document that will require a signature (you can do this online during the sign-up process). The TOA provides us with permission to obtain records from the life companies regarding your pension(s).

That’s all we initially need to start tracking down your pension(s). We write to the pension providers and request that they send us your pension details for any and all that they have for you.

If nothing comes back, it might be that the pension was under a different name (such as maiden name), or a previous address, so we might look to find out more specific information to look further into where your pension(s) might be.

The more information you give us, the easier it will be to find your pension, such as previous employment, etc.

What happens once my pensions are located?

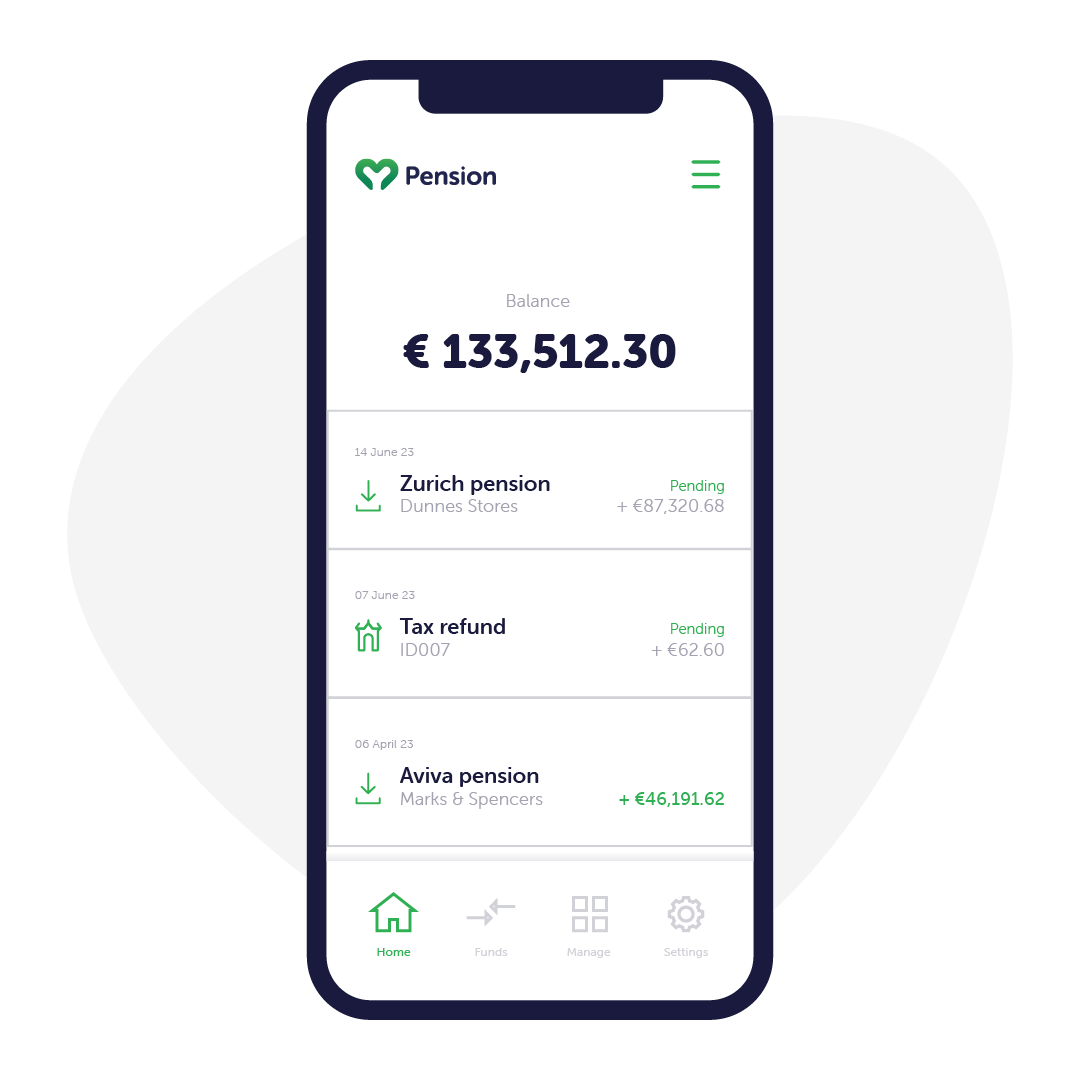

Once we have successfully located your pensions, you will be able to access and manage your pensions online, using MyPension.ie or our mobile App.

This is particularly useful as you can gain access to your pension balance 24/7, as well as policy information (providers, number, amounts, etc.). You can also manage your pensions with helpful features such as switching pension plans, accessing withdrawals and use our useful tools such as our pension calculator to ensure you’re on track to reach your retirement goals.

Once located, you have several options available to you, dependant on the type of pension. If it’s an old workplace pension, a personal pension, or even an overseas pension, MyPension can present your options and provide reccomendations based on your current circumstances and retirement goals.

Useful Links / Documents

Pension Calculator

Find out your likely retirement income.

Find your old Workplace Pensions

Sign-up and find all of your pensions.

Common Questions about Finding your Pension in Ireland (FAQ)

Is there an app where I can see all my pensions?

Yes, our MyPension App allows you to view all your pensions in one place. This is particularly useful as you can gain access to your pension balance 24/7, as well as policy information (providers, number, amounts, etc.). You can also manage your pensions with helpful features such as switching pension plans, accessing withdrawals and use our useful tools such as our pension calculator to ensure you’re on track to reach your retirement goals.

How do I monitor my pension?

You can monitor your pension using MyPension.ie. This will give you access to your pension balance 24/7, as well as policy information (providers, number, amounts, etc.). You can also manage your pensions with helpful features such as switching pension plans, accessing withdrawals and use our useful tools such as our pension calculator to ensure you’re on track to reach your retirement goals.

Am I entitled to a UK pension in Ireland?

Yes, you are entitled to a UK personal or workplace pension if residing in Ireland, if you have one in the UK. There are several options of accessing this pension, either via the UK or transferring it to Ireland. If you want to learn more about your options, contact one our advisors today.

If I do trace a pension can I cash it in?

Yes, you can access your pensions at retirement age.

How can I transfer old pensions?

You can transfer Irish pensions easily by selecting “Switch” on the My Pension App, or online. This facility allows you to chose which pension you are interested in transferring, and one of our financial advisors will be in contact to help guide you through options.

Will I lose my pension if I don't find it?

In general, your pension will still exist, but if you don’t locate your pension you won’t be able to access it. On death, pensions go to your estate; however, again, if your pension is not located, your estate will not know about it and it will remained un-accessed. It’s estimated that approximately €500m in pension benefits go unclaimed in Ireland.

What's the fastest way for me to find all my pensions?

Using a pension tracing service such as MyPension.

- Sign-up to MyPension. Here, you will input some basic details such as name, date of birth, address, etc.

- We will then issue a Transfer of Agency (TOA) document that will require a signature (you can do this online during the sign-up process). The TOA provides us with permission to obtain records from the life companies regarding your pension(s).

That’s all we initially need to start searching. We right to the pension providers and request that they send us your pension details for any and all that they have for you.

If nothing comes back, it might be that the pension was under a different name (such as maiden name), or a previous address, so we might look to find out more specific information to look further into where your pension(s) might be.

The more information you give us, the easier it will be to locate, such as previous employment, etc.

Alternatively, speak with one of our advisors today, who can start the process of tracing your pension.

What if my old company closed? Do I lose that pension?

No, your pension with that employer will likely be somewhere and just needs locating. In this event, details of your old employer and your period of employment will be useful to help us locate your pension.

Take control of your retirement, with MyPension

View all your pensions in one place. MyPension allows you to easily manage your pensions, with features such as combining, contributing and making withdrawals. Your pension, in the palm of your hands.

Cathedral Financial Consultants Ltd t/a My Pension is regulated by the Central Bank of Ireland. With pension investments, your funds might fluctuate in line with investment market movements.

Client services

© Copyright 2024 Cathedral Financial Consultants Ltd t/a My Pension. Registered in Ireland No: 369995.