Take control of your retirement.

View and manage all your pensions in one place.

Join the 4,054 users and counting…

Watch our explainer video

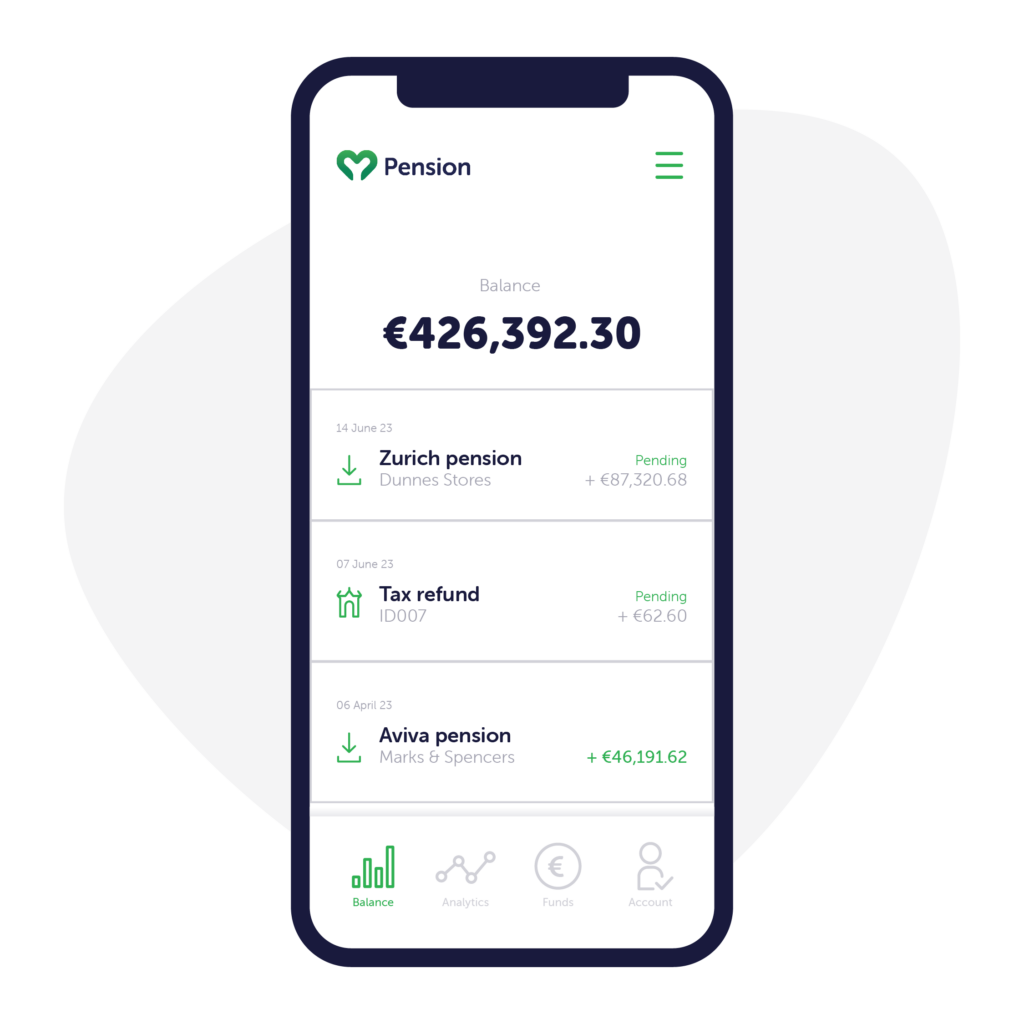

Your pension,

in the palm of your hand.

Take control of your retirement with MyPension.

View all your pensions in one place. MyPension allows you to easily manage your pensions, with features such as combining, contributing and making withdrawals. Your pension, in the palm of your hands.

Watch our explainer video

Display all pensions online

Simply tell us the names of your old pension providers and give some basic information to have all your pensions in the one place. We’ll source your pensions and display the amount that you can view on the MyPension Dash. Your pension in the palm of your hand. Sign-up today to get started.

Switch with a click

Simply select the plans you’re interested in switching and we’ll provide you with a recommendation relative to your retirement goals. We take an in-depth look into your current plans as some could come with special benefits you might want to keep!

Contribute or Withdraw easily

If you want to contribute to your pension either one-off or regular (monthly) contributions, simply select “contribute” on your MyPension Dash, to start the process. When it comes to withdrawing your pension, select “Withdraw” on your MyPension Dash, to start the process.

Display all pensions online

Simply tell us the names of your old pension providers and give some basic information to have all your pensions in the one place. We’ll source your pensions and display the amount that you can view on the MyPension Dash. Your pension in the palm of your hand.

Switch with a click

Simply select the plans you’re interested in switching and we’ll provide you with a recommendation relative to your retirement goals. We take an in-depth look into your current plans as some could come with special benefits you might want to keep!

Contribute or Withdraw easily

If you want to contribute to your pension either one-off or regular (monthly) contributions, simply select “contribute” on your MyPension Dash, to start the process. When it comes to withdrawing your pension, select “Withdraw” on your MyPension Dash, to start the process.

Give your pension some attention.

Our website and app gives you the tools to help manage your pension in one place. Whether you’re wanting to track down old workplace pensions, get your savings back on track, start a new pension or even withdraw your pension, MyPension provides the platform and back office to make all that possible. Your pension, in the plam of your hand.

Everything is designed to give you pension peace of mind.

Give your pension some attention.

Our website and app gives you the tools to help manage your pension in one place. Whether you’re wanting to track down old workplace pensions, get your savings back on track, start a new pension or even withdraw your pension, MyPension provides the platform and back office to make all that possible. Your pension, in the plam of your hand.

Everything is designed to give you pension peace of mind.

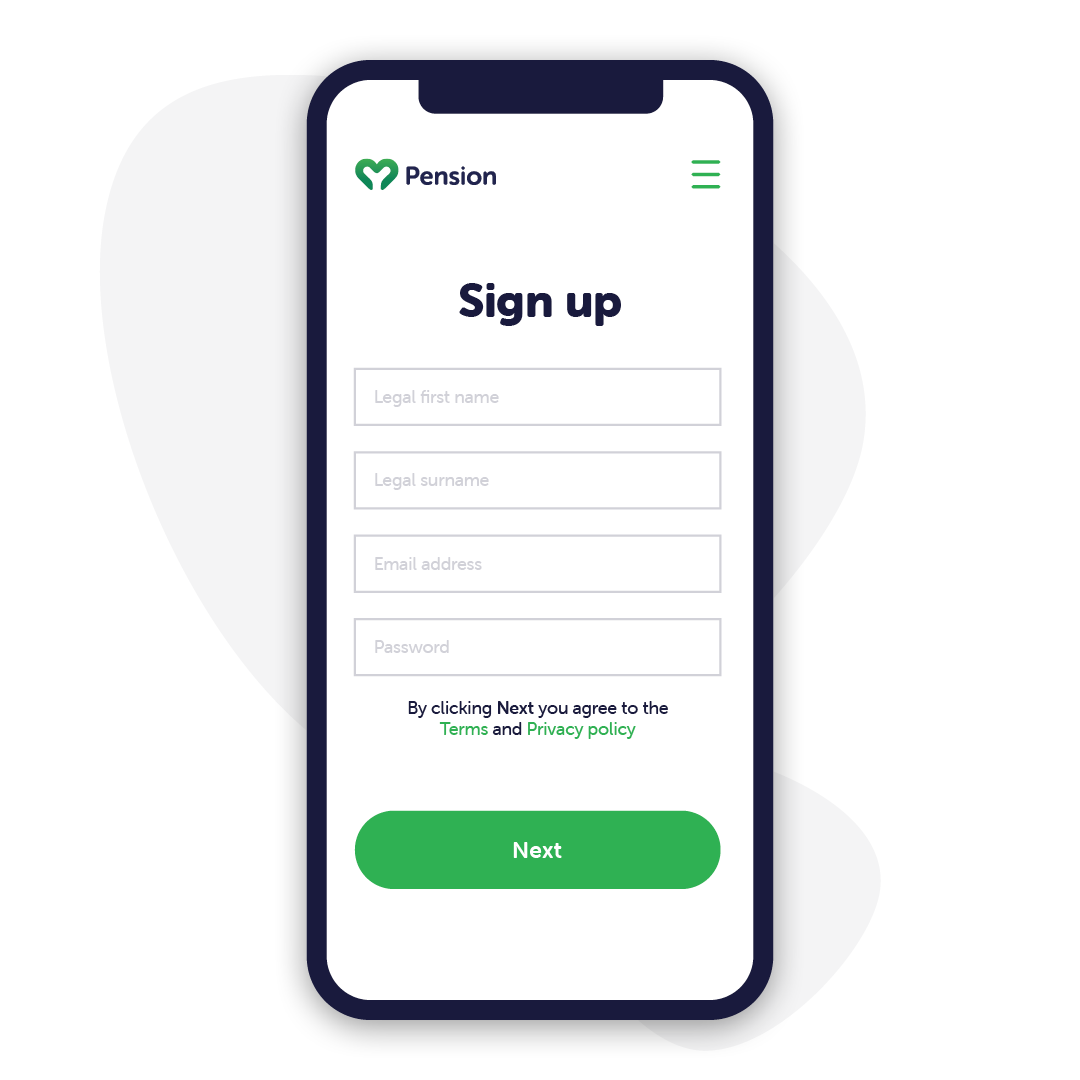

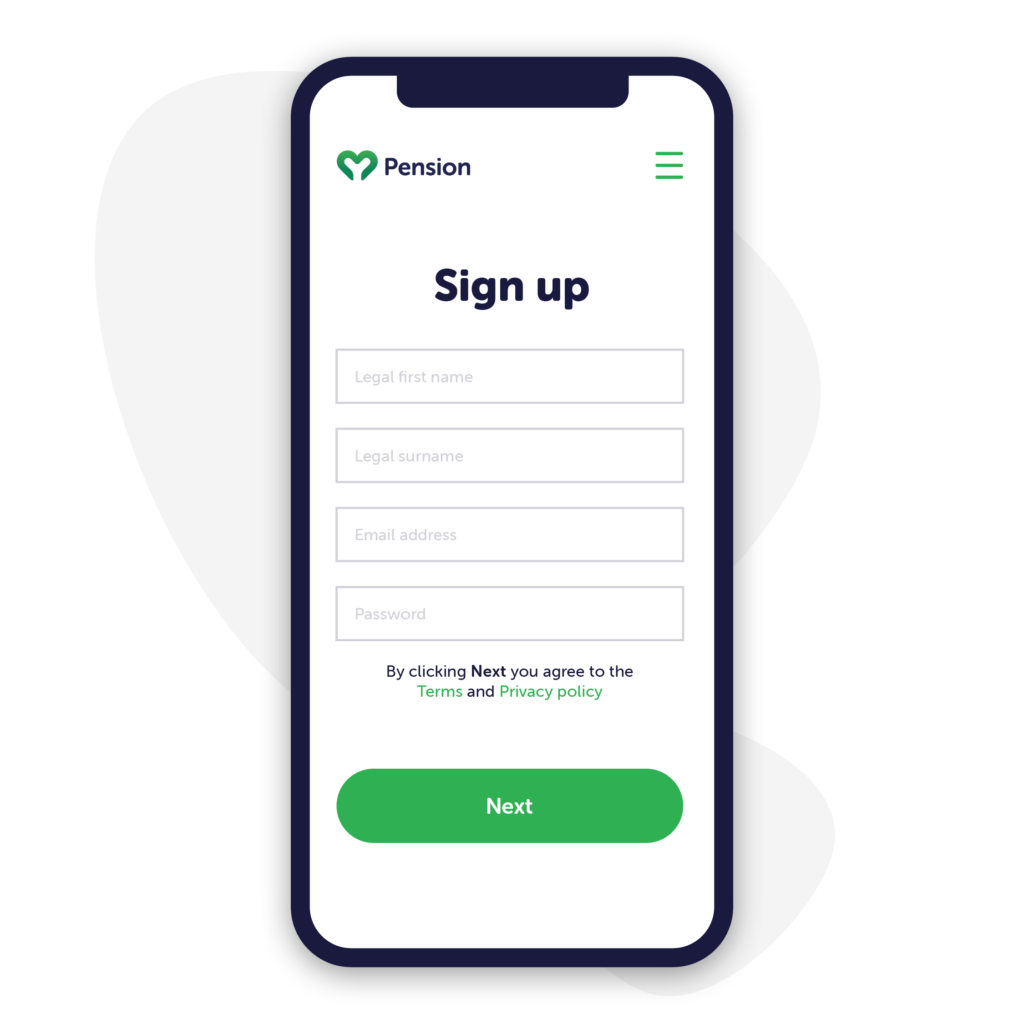

Sign up in minutes, for free

Simply sign up online with some basic details. You don’t need policy numbers (although this could speed up the process), and we will locate your pension(s) for you. Joining us is free.

You can view all your pensions in the one place, switch pension plans easily, set up a new pension plan, top up and even withdraw your pension(s), via our service.

Leave the rest to us

That’s all we need to start contacting your old providers! On average, transferring to MyPension typically takes around 4 weeks. Your personal Financial Advisor will provide regular updates every step of the way.

If we discover that an old pension provider charges an exit fee and you wish to switch, or that your pension comes with special benefits or guarantees, your personal [financial] advisor will provide you with advice on how you should proceed, as when it comes to switching pensions, we want to ensure that you’re making the right decision, for your future.

Tell us about your pensions

Just give us some basic pension information – like a provider name or where you worked – then confirm that you’d like to transfer. Agency transfers don’t change your pension, or cost you anything, it simply gives us the permission we require to access your pension information and make accessible to you via our database.

Not sure how to find your old pension details? Simply sign-up and “add a pension”. We take some basic information and your approval to search, then work to locate the pensions via the various providers.

Sign up in minutes, for free

Simply sign up online with some basic details. You don’t need policy numbers (although this could speed up the process), and we will locate your pension(s) for you. Joining us is free.

You can view all your pensions in the one place, switch pension plans easily, set up a new pension plan, top up and even withdraw your pension(s), via our service.

Tell us about your pensions

Just give us some basic pension information – like a provider name or where you worked – then confirm that you’d like to transfer. Agency transfers don’t change your pension, or cost you anything, it simply gives us the permission we require to access your pension information and make accessible to you via our database.

Not sure how to find your old pension details? Simply sign-up and “add a pension”. We take some basic information and your approval to search, then work to locate the pensions via the various providers.

Leave the rest to us

That’s all we need to start contacting your old providers! On average, transferring to MyPension typically takes around 4 weeks. Your personal Financial Advisor will provide regular updates every step of the way.

If we discover that an old pension provider charges an exit fee and you wish to switch, or that your pension comes with special benefits or guarantees, your personal [financial] advisor will provide you with advice on how you should proceed, as when it comes to switching pensions, we want to ensure that you’re making the right decision, for your future.

Your pension is protected, every step of the way.

Experienced money managers

Our pension funds are managed by some of the largest and most experienced money managers in Ireland, including Zurich, Aviva, New Ireland, Irish Life, Royal London and Standard Life.

High-grade security

We protect your data with up-to-date technology and processes. All of your information is stored securely within our database.

Permission-only data sharing

We'll never share your personal information with anyone without your permission. Our systems and processes are set up to adhere to the EU General Data Protection Regulation (EU GDPR).

.

Cathedral Financial Consultants Ltd t/a My Pension is regulated by the Central Bank of Ireland. With pension investments, your funds might fluctuate in line with investment market movements.

Client services

© Copyright 2025 Cathedral Financial Consultants Ltd t/a My Pension. Registered in Ireland No: 369995.

Secure identity checks

Secure identity checks